United States Functional Food Market Size & Forecast (2026–2034)

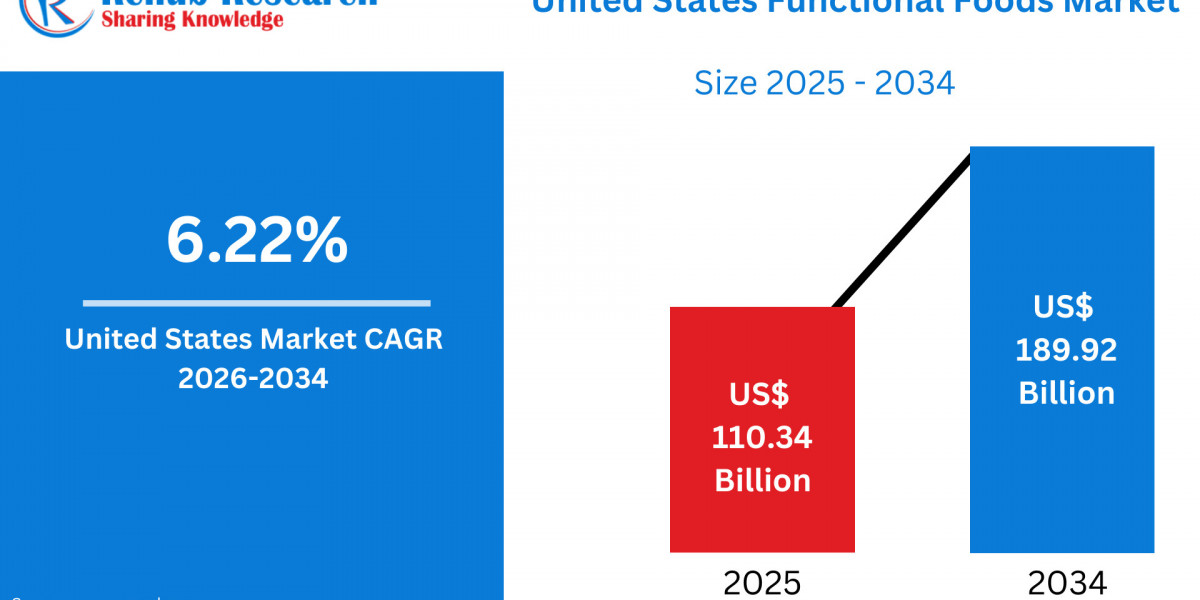

According to Renub Research United States functional food market is experiencing strong and sustained expansion as consumers increasingly view food as a proactive tool for health management rather than simply a source of calories. Valued at US$ 110.34 billion in 2025, the market is projected to reach US$ 189.92 billion by 2034, registering a compound annual growth rate (CAGR) of 6.22% from 2026 to 2034. This growth trajectory reflects rising awareness of nutrition, preventive healthcare, and lifestyle-driven wellness across the country.

Functional foods—products that deliver health benefits beyond basic nutrition—have evolved into a core segment of the U.S. food industry. Elevated demand for probiotic foods, fortified beverages, protein-rich snacks, and naturally health-enhancing ingredients continues to reshape product portfolios and retail strategies. As consumers seek convenient ways to support immunity, digestion, heart health, cognitive performance, and energy levels, functional foods are increasingly embedded into everyday eating habits.

Download Free Sample Report:

https://www.renub.com/request-sample-page.php?gturl=united-states-functional-foods-market-p.php

United States Functional Food Market Outlook

Functional foods are defined by their inclusion of bioactive components such as probiotics, vitamins, minerals, antioxidants, dietary fiber, plant extracts, and specialty proteins. These ingredients are designed to support specific bodily functions while being consumed in familiar food formats like cereals, dairy products, beverages, bakery items, and snacks.

In the United States, functional foods have gained widespread popularity due to rising health consciousness and a strong shift toward preventive wellness. Consumers are increasingly motivated to manage stress, improve gut health, boost immunity, and maintain consistent energy through daily dietary choices rather than relying solely on supplements or pharmaceutical solutions.

Convenience is a major contributor to adoption. Ready-to-eat and ready-to-drink functional foods appeal to busy professionals, students, parents, and fitness-oriented consumers. At the same time, growing interest in plant-based eating, clean-label formulations, and natural ingredients has strengthened consumer trust in functional food products. With supermarkets, specialty stores, online platforms, and foodservice operators expanding their functional food offerings, these products are now firmly positioned within mainstream American diets.

Growth Drivers in the United States Functional Food Market

Increasing Health Awareness and Preventive Wellness

One of the most influential growth drivers in the U.S. functional food market is the increasing emphasis on preventive healthcare and long-term wellness. Consumers are proactively seeking foods that provide targeted health benefits, such as immune support, digestive balance, cardiovascular protection, metabolic health, and cognitive function.

This trend is reinforced by aging demographics, higher incidence of lifestyle-related diseases, and rising healthcare costs. Functional foods offer an accessible and low-effort solution by allowing consumers to improve health outcomes through routine eating behaviors. Products such as fortified cereals, probiotic yogurts, omega-3–enriched foods, and stress-support beverages enable consumers to integrate wellness into their daily lives without major lifestyle disruption.

Innovation in Formulation and Sensory Experience

Continuous product innovation plays a critical role in driving consumer adoption and repeat purchases. Earlier generations of functional foods often prioritized efficacy over taste, which limited their appeal. Modern formulations, however, successfully balance health functionality with sensory satisfaction.

Manufacturers are using advanced food science techniques such as microencapsulation, improved stabilization methods, and natural flavor systems to protect active ingredients while maintaining desirable taste and texture. Functional foods now appear in indulgent formats such as snack bars, crisps, smoothies, and ready-to-drink beverages that deliver measurable benefits without sacrificing enjoyment.

Another important trend is the rise of multi-functional products, combining protein, probiotics, fiber, vitamins, and botanicals in a single offering. These products address multiple wellness needs simultaneously and resonate strongly with consumers seeking efficiency and value in their food choices.

Channel Expansion and Personalized Digital Commerce

The expansion of distribution channels has significantly increased market penetration. While supermarkets and hypermarkets remain central to volume sales, functional foods are increasingly available through specialist wellness retailers, convenience stores, fitness centers, and online platforms.

E-commerce has emerged as a particularly powerful growth channel. Online platforms allow brands to educate consumers in detail about ingredient sourcing, scientific validation, and usage recommendations. Subscription models, personalized product bundles, and targeted digital marketing enhance customer retention and lifetime value. Integration with nutrition apps and digital wellness platforms further supports personalized consumption, encouraging repeat purchases and brand loyalty.

Challenges in the United States Functional Food Market

Regulatory Ambiguity and Evidence Expectations

Despite robust demand, regulatory uncertainty remains a key challenge. Functional foods operate in a space between conventional foods and dietary supplements, creating ambiguity around labeling, ingredient approvals, and allowable health claims. Companies must carefully frame their marketing messages to avoid implying disease prevention or treatment, which could trigger regulatory scrutiny.

At the same time, consumers increasingly expect credible scientific evidence to support functional claims. Generating clinical data is resource-intensive, posing barriers for smaller companies. Larger brands face reputational risk if marketed benefits are perceived as overstated or unsupported. Navigating regulatory compliance while maintaining consumer trust requires substantial investment in research, quality assurance, and transparent communication.

Ingredient Sourcing, Cost Pressures, and Supply Chain Risk

Securing consistent, high-quality functional ingredients is another major challenge. Inputs such as probiotics, botanical extracts, specialty proteins, and omega-3 concentrates are often subject to agricultural variability, geopolitical factors, and limited supplier bases. These dynamics can lead to pricing volatility and margin pressure.

Supply chain disruptions—caused by transportation delays, climate events, or capacity constraints—can affect product availability and brand reliability. Additionally, rising consumer expectations around sustainability and traceability require investments in certifications, audits, and diversified sourcing strategies, further increasing operational complexity.

United States Breakfast Cereals Functional Food Market

Functional breakfast cereals have evolved from simple vitamin fortification to advanced nutritional platforms. Modern cereals incorporate probiotics, prebiotic fibers, plant-based proteins, omega-3 fatty acids, and botanical ingredients to support immunity, gut health, energy regulation, and cognitive performance.

Manufacturers increasingly emphasize whole grains, reduced sugar content, and clean-label ingredients. Convenient single-serve formats cater to on-the-go consumers, while targeted formulations address the nutritional needs of children, adults, and seniors. Retailers are dedicating more shelf space to functional cereal ranges, reinforcing breakfast as a key wellness occasion.

United States Baby Functional Food Market

The baby functional food segment caters to parents seeking enhanced nutrition for infants and toddlers during critical growth stages. Products include fortified baby cereals, DHA-enriched purees, probiotic toddler snacks, and prebiotic-enhanced formulas designed to support digestive and immune development.

Safety, transparency, and clinical validation are paramount in this category. Parents demand strict quality controls, clear ingredient sourcing, and age-appropriate formulations. Packaging innovations such as resealable pouches and portion-controlled servings improve convenience, while marketing focuses on developmental milestones rather than adult-style wellness claims.

United States Probiotics Functional Food Market

Probiotic functional foods have transitioned from niche offerings to mainstream staples in the U.S. market. Beyond traditional yogurt, probiotics are now incorporated into beverages, snack bars, cereals, and shelf-stable shots.

Consumer interest is driven by awareness of the gut–immune and gut–brain connections, with perceived benefits including improved digestion, enhanced immunity, and mental well-being. Differentiation is based on strain specificity, colony-forming unit (CFU) counts, shelf-life stability, and delivery technology. Brands that communicate clear, evidence-backed benefits tend to achieve higher trust and premium positioning.

United States Vitamins Functional Food Market

Vitamin-enriched functional foods have shifted from generic fortification to targeted and occasion-based nutrition. Products address specific needs such as energy support, immune defense, mood balance, and bone health.

Consumers increasingly prefer naturally sourced vitamins, improved bioavailability, and transparent labeling. Delivery formats such as powders, gummies, fortified beverages, and dairy products enable flexible dosing and broaden appeal across age groups. Subscription models and online sales further support regular consumption patterns.

United States Functional Food Specialist Retailers Market

Specialist retailers, including natural food stores and wellness-focused grocers, play a critical role in shaping consumer perceptions of functional foods. These outlets emphasize curated assortments, third-party certifications, and educational support through knowledgeable staff and in-store demonstrations.

Specialist retailers often act as trend incubators, introducing emerging concepts such as adaptogens, plant-based proteins, and clean-label superfoods before they reach mass-market channels.

United States Functional Food Online Market

E-commerce has transformed functional food distribution by enabling direct engagement between brands and consumers. Online platforms support detailed storytelling around ingredients, health benefits, and scientific validation, which is particularly important in functional categories.

Personalized recommendations, influencer marketing, and subscription services enhance customer retention. Improvements in cold-chain logistics have also expanded online availability of fresh functional products, including probiotic beverages and wellness shots.

United States Sports Nutrition Market

Sports nutrition represents one of the strongest subsegments within the functional food market. Demand is driven by rising gym participation, endurance sports, home fitness adoption, and a broader cultural emphasis on active lifestyles.

Products focus on muscle recovery, hydration, joint health, and performance support, with increasing emphasis on low-sugar and plant-based formulations. Ingredient quality, third-party testing, and transparent labeling are critical to building trust among athletes and fitness-conscious consumers.

State-Level Market Insights

California Functional Food Market

California leads the U.S. functional food landscape due to its strong wellness culture, innovation ecosystem, and health-conscious consumer base. Demand is particularly strong for plant-based, clean-label, and sustainably sourced functional foods.

New York Functional Food Market

New York’s diverse population and fast-paced lifestyle support rapid adoption of functional food concepts. Grab-and-go functional meals, fortified bakery products, and probiotic beverages perform well across retail and foodservice channels.

Market Segmentation Overview

By Product Type:

Bakery Products, Breakfast Cereals, Snacks and Functional Bars, Dairy Products, Baby Food, Others

By Ingredient:

Probiotics, Minerals, Proteins and Amino Acids, Prebiotics and Dietary Fiber, Vitamins, Others

By Distribution Channel:

Supermarkets and Hypermarkets, Specialist Retailers, Convenience Stores, Online Stores, Others

By Application:

Sports Nutrition, Weight Management, Clinical Nutrition, Cardio Health, Others

By Top States:

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, and others

Competitive Landscape and Company Analysis

The U.S. functional food market is highly competitive and innovation-driven. Major players focus on product development, scientific validation, clean-label positioning, and omnichannel distribution. Companies are evaluated across multiple dimensions, including company overview, key leadership, recent developments, SWOT analysis, and revenue performance, reflecting the dynamic and evolving nature of the market.

Conclusion

The United States functional food market is poised for continued growth through 2034, supported by strong consumer demand for nutrition-driven wellness, innovation in formulations, and expanding digital distribution. While regulatory complexity and supply chain challenges persist, the long-term outlook remains positive as functional foods become an integral part of everyday American diets.