Saudi Arabia Digital Diabetes Management Market Overview

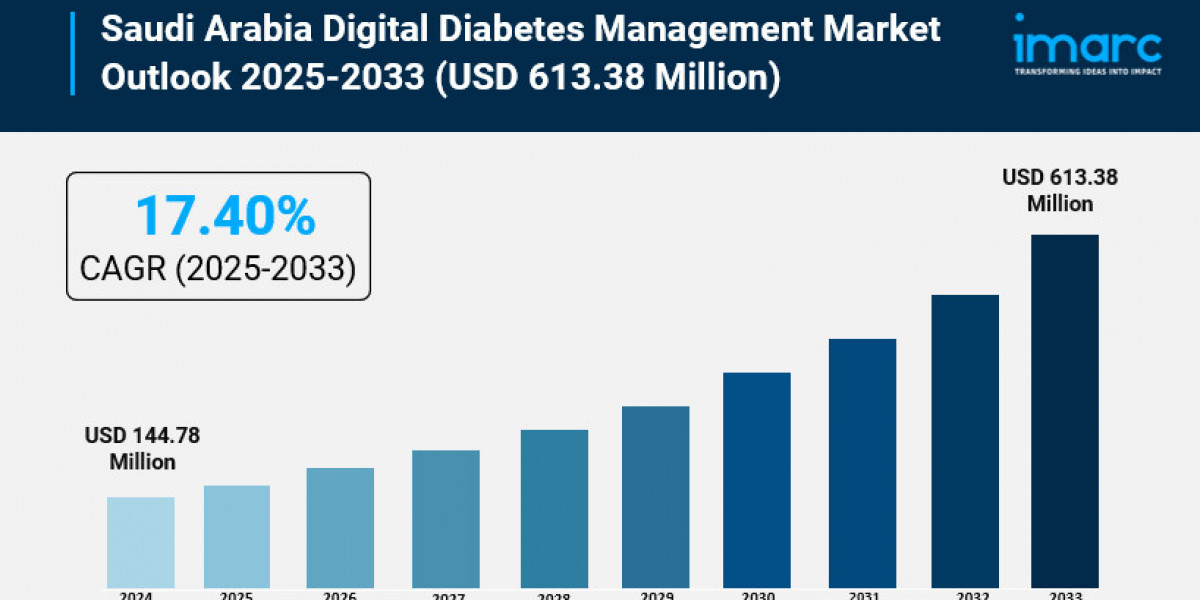

Market Size in 2024: USD 144.78 Million

Market Forecast in 2033: USD 613.38 Million

Market Growth Rate 2025-2033: 17.40%

According to IMARC Group's latest research publication, "Saudi Arabia Digital Diabetes Management Market Size, Share, Trends and Forecast by Product Type, Device Type, and Region, 2025-2033", The Saudi Arabia digital diabetes management market size reached USD 144.78 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 613.38 Million by 2033, exhibiting a growth rate (CAGR) of 17.40% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-digital-diabetes-management-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Digital Diabetes Management Market

- AI-driven continuous glucose monitors provide real-time insights, improving blood sugar control for over 60% of users, reducing emergency visits dramatically.

- Saudi Ministry of Health’s AI-powered Diabetes Command Center enables personalized patient tracking, cutting complication rates by 18% nationwide.

- AI algorithms enhance remote diagnostics, boosting early detection of diabetic retinopathy and neuropathy, benefiting more than 1 million Saudis annually.

- AI-integrated mobile apps deliver customized lifestyle coaching and medication reminders, increasing patient adherence rates by approximately 25%.

- Leading digital health firms partner with Saudi healthcare providers to deploy AI-based predictive analytics, optimizing diabetes treatment plans and reducing costs significantly.

Saudi Arabia Digital Diabetes Management Market Trends & Drivers:

Saudi Arabia's digital diabetes management market is surging thanks to the skyrocketing number of people living with diabetes—over 10% of the population right now, according to the International Diabetes Federation, which puts real pressure on traditional healthcare setups. This has sparked a rush toward apps, wearables, and platforms that let patients track glucose levels, log meals, and get instant feedback from home, making daily management feel less like a chore and more empowering. Vision 2030 plays a huge role here, with the government channeling massive funds into digital health as part of healthcare reforms, including the Health Holding Company's push for remote monitoring and AI tools to handle the caseload without overwhelming hospitals. On the ground, this means more clinics integrating telemedicine, where patients in remote areas connect with specialists via smartphones, cutting wait times and travel hassles. Companies are jumping in too, rolling out CGM devices and smart insulin pens that sync real-time data to doctors, helping spot issues before they escalate and easing the burden on Saudi Arabia's 60% share of GCC healthcare spending. It's all creating a more proactive scene where folks aren't just surviving diabetes but actually thriving with personalized nudges.

Government-backed digital health initiatives are supercharging this market, especially through the Ministry of Health's focus on primary care upgrades and widespread telemedicine rollout amid rising internet access across the kingdom. Saudi Arabia boasts top-tier smartphone penetration and 4G/5G coverage, letting millions download apps for seamless glucose tracking, medication reminders, and virtual coaching that fits right into busy lifestyles. Real-world wins include platforms linking patients to providers for remote check-ins, which exploded post-pandemic and now help optimize outcomes while trimming costs—think fewer emergency visits for uncontrolled sugar spikes. Recent company moves, like innovations in AI-driven analytics from health-tech firms, are tailoring advice to individual patterns, such as predicting lows based on diet or activity. This ties into broader pushes like preventive care programs under Vision 2030, where public campaigns boost awareness of these tools, drawing in even non-tech-savvy users through user-friendly interfaces and Arabic support. The result? A connected ecosystem where diabetes care feels accessible and modern, driving everyday adoption.

Technological leaps like AI, wearables, and integrated apps are transforming how Saudis tackle diabetes, with continuous glucose monitors and smart devices now standard for real-time insights that traditional methods can't match. These tools use machine learning to deliver custom plans—say, adjusting insulin doses based on live data from your phone or watch—making management intuitive and effective for busy families or professionals. Market buzz includes partnerships pushing automated insulin systems and cloud platforms that share data across caregivers, slashing hospitalization risks through early alerts. With consumers ditching old-school logs for these high-tech options, uptake is booming, fueled by improved connectivity and a cultural shift toward self-care. Hospitals report better patient adherence, as apps gamify tracking with reminders and progress visuals, while remote monitoring frees up resources for complex cases. It's no wonder digital solutions are becoming the go-to, blending convenience with cutting-edge smarts to keep diabetes in check.

Saudi Arabia Digital Diabetes Management Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- Smart Glucose Meter

- Smart Insulin Pumps

- Smart Insulin Pens

- Apps

Device Type Insights:

- Handheld Devices

- Wearable Devices

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Digital Diabetes Management Market

- October 2025: Saudi Ministry of Health launched the world’s first AI-powered Diabetes Command Center, improving real-time patient monitoring and reducing complications by 20%.

- September 2025: A leading health tech firm introduced AI-integrated continuous glucose monitors, enhancing glucose tracking accuracy by 30% for diabetic patients nationwide.

- August 2025: Saudi telecom provider partnered with digital health startups to deploy AI-driven diabetes management apps, increasing patient adherence to treatment plans by 25%.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302