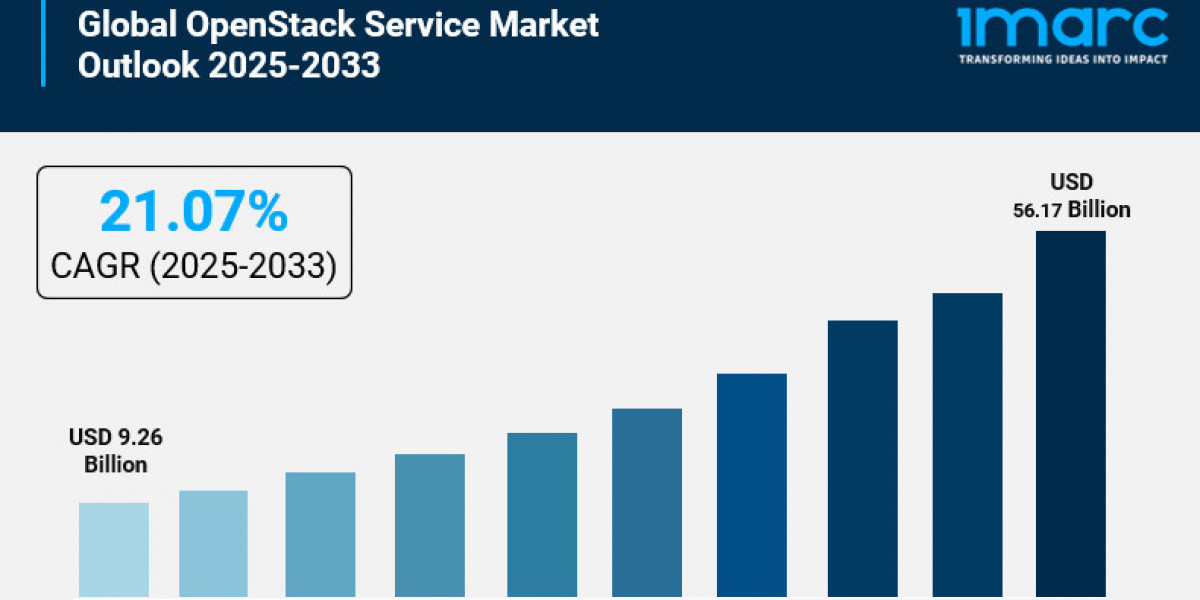

The global OpenStack service market was valued at USD 9.26 Billion in 2024 and is projected to reach USD 56.17 Billion by 2033, growing at a CAGR of 21.07% during the forecast period of 2025-2033. The market is driven by rising cloud infrastructure adoption, open-source deployment models, cost-effective cloud storage capabilities, and a surge in digital transformation across various sectors. By 2024, North America is expected to continue to dominate the market, with over 37.2% share owing to its cloud infrastructure, enterprise uptake, advanced technologies, and established IT ecosystem. The study provides a detailed analysis of the industry, including the OpenStack Service Market report, trends, growth, size, and industry growth forecast.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

OpenStack Service Market Key Takeaways

- Current Market Size: USD 9.26 Billion in 2024

- CAGR: 21.07%

- Forecast Period: 2025-2033

- North America dominates with over 37.2% market share in 2024, driven by advanced cloud infrastructure.

- Solution component leads the market with extensive cloud management features and scalability.

- Information Technology represents the largest application segment with strong infrastructure demands.

- United States accounts for 88.10% of North American market, driven by cloud adoption.

- Growing integration of AI, big data, and edge computing accelerates market expansion.

Request for a Free Sample Report: https://www.imarcgroup.com/openstack-service-market/requestsample

Market Growth Factors

The primary factor driving the growth of the global OpenStack service market is the rising demand for cloud- and internet-based services, with various verticals gradually shifting towards cloud-based infrastructure to increase scalability, reduce capital expenditure, and improve operational agility. OpenStack represents one of many open-source, flexible, scalable choices to current commercial clouds, and it lets organization users deploy and run cloud-based infrastructures affordably as they avoid commercial solution licensing costs. As an open-source solution, it avoids vendor lock-in by controlling and being autonomous with the infrastructure and relying less on proprietary systems. OpenStack adoption is increasing through digital transformation initiatives because businesses discover infrastructure modernization makes them agile and competitive.

Growth from telecom operators and SMEs are expected to account for a majority of the market share, as OpenStack is an affordable substitute for high license fees of proprietary software by SMEs. The modularized architecture of OpenStack enables SMEs to customize their cloud environment and avoid vendor lock-in with proprietary software. Telecom industry users of OpenStack have been reported as using it to scale infrastructure to more easily store and handle big data and to support the roll-out of new technologies like 5G. OpenStack's ability to deploy cloud environments in an easy-to-configure way, including configuration for virtualization and containers, furthered its adoption in the telecom industry.

The highly parallelized nature of cloud infrastructure, big data analytics, and the application of smart technologies such as AI requires cloud computing infrastructure to have a scalable architecture. OpenStack's modular architecture can satisfy this requirement. OpenStack is used by organizations in a variety of industries that want to run workloads for machine learning, stream and batch processing of web events, video transcoding or predictive analytics. It can be integrated with many other technologies making it an ideal platform for data-focused organizations. As AI and analytics capabilities become a competitive differentiator, OpenStack is increasingly used for running these applications in enterprise environments.

Market Segmentation

Analysis by Component Type:

- Solution: Holds the biggest market share due to extensive cloud management features, scalability, and cost effectiveness. Organizations are progressively adopting OpenStack-driven private and hybrid cloud solutions to improve infrastructure, boost security, and effectively manage workloads. The need for cloud automation, orchestration, and virtualization boosts implementation of OpenStack solutions.

- Services: Includes consulting, implementation, training, support, and managed services helping organizations deploy and maintain OpenStack environments effectively.

Analysis by Organization Size:

- Large Enterprises: Extensively deploy OpenStack services to manage vast IT infrastructures, ensuring scalability, flexibility, and cost efficiency. These organizations benefit from OpenStack's open-source nature, avoiding vendor lock-in while optimizing multi-cloud and hybrid-cloud strategies.

- Medium Enterprises: Adopt OpenStack for cost-effective cloud solutions, balancing operational efficiency with affordability. They leverage OpenStack to scale workloads dynamically, manage containerized applications, and enhance data security.

- Small Enterprises: Utilize OpenStack primarily for affordable cloud infrastructure, enabling efficient virtualization and container management. With minimal IT resources, these businesses benefit from OpenStack's automation and open-source support communities.

Analysis by Platform:

- Public Cloud: Offers businesses scalable, economical infrastructure overseen by external providers. These solutions serve businesses requiring on-demand resources without investing in hardware, enhancing global accessibility while minimizing IT management challenges.

- Private Cloud: Provides superior security, control, and customization for businesses handling sensitive information and compliance needs. Sectors such as finance, healthcare, and government implement private cloud solutions to guarantee data sovereignty and regulatory adherence.

- Hybrid: Combines public and private cloud settings, enabling companies to achieve balance between flexibility and security. Businesses utilize hybrid approaches to enhance workload allocation, boost disaster recovery, and scale operations effectively.

Analysis by Application:

- BFSI: Banking, financial services, and insurance sector adopting OpenStack for secure and compliant cloud infrastructure.

- Government and Defense: Implementing OpenStack for data sovereignty and secure cloud environments.

- Information Technology: Represents the largest segment due to strong demand for scalable, adaptable, and economical cloud solutions. IT firms need robust cloud infrastructure to effectively handle extensive data processing, software development, and enterprise applications. The open-source characteristic enables IT companies to tailor cloud environments and enhance workloads.

- Telecommunication: Leveraging OpenStack for network virtualization and 5G infrastructure.

- Academic and Research: Utilizing OpenStack for collaborative computing and research projects.

- Retail and E-Commerce: Adopting cloud solutions for scalable online platforms and customer data management.

- Manufacturing: Implementing OpenStack for industrial automation and supply chain optimization.

- Others: Including healthcare, media, energy, and various emerging sectors.

Analysis by Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Countries Covered: United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico

Regional Insights

With a 37.2% market share in 2024, North America has the largest share of the global cloud market due to an advanced cloud ecosystem, higher enterprise cloud adoption, and advanced technological innovations. The region also has several prominent Cloud vendors, technology companies, and OpenStack contributors. With local demand for dense, inexpensive, vertically and horizontally scalable cloud services, the OpenStack open-source community sees possible growth in the AI, big data and edge computing markets, which have developed rapidly. Businesses running OpenStack in hybrid and multi-cloud environments require performance, security and data protection compliance, and stability for their production workloads.

Recent Developments & News

In January 2025, Mirantis announced the launch of an open source project, Rockoon, to manage the deployment of OpenStack services on Kubernetes, in response to the demand for such a low-cost alternatives. In January 2025, UNICC launched the UN system's private cloud, UNIQCloud, running OpenStack. In October 2024, Rackspace Technology joined the OpenInfra Foundation Board as a Platinum Member, which reflects their commitment to the OpenStack community. In August of 2024, Red Hat announced the general availability of the Red Hat OpenStack Services for OpenShift. Rackspace Technology announced in August 2024 Rackspace OpenStack Enterprise with features for enterprise security, economics, and scalability. In July 2024, Mirantis released MOSK 24.2 with performance and AI optimizations.

Key Players

- Bright Computing Inc.

- Canonical

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- IBM

- Mirantis Inc.

- Oracle Corporation

- Rackspace Inc.

- Red Hat Inc.

- SUSE

- VMware Inc.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=2134&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302