The Instrument Transformer Market plays a crucial role in the electrical power transmission and distribution ecosystem. Instrument transformers primarily current transformers (CTs) and potential (voltage) transformers (PTs) are specialized devices used to step down high voltages and currents to measurable levels for protection, metering, monitoring, and control equipment. Their importance has only grown as global power systems expand, modernize and integrate renewable energy sources to support reliable, resilient and efficient grids.

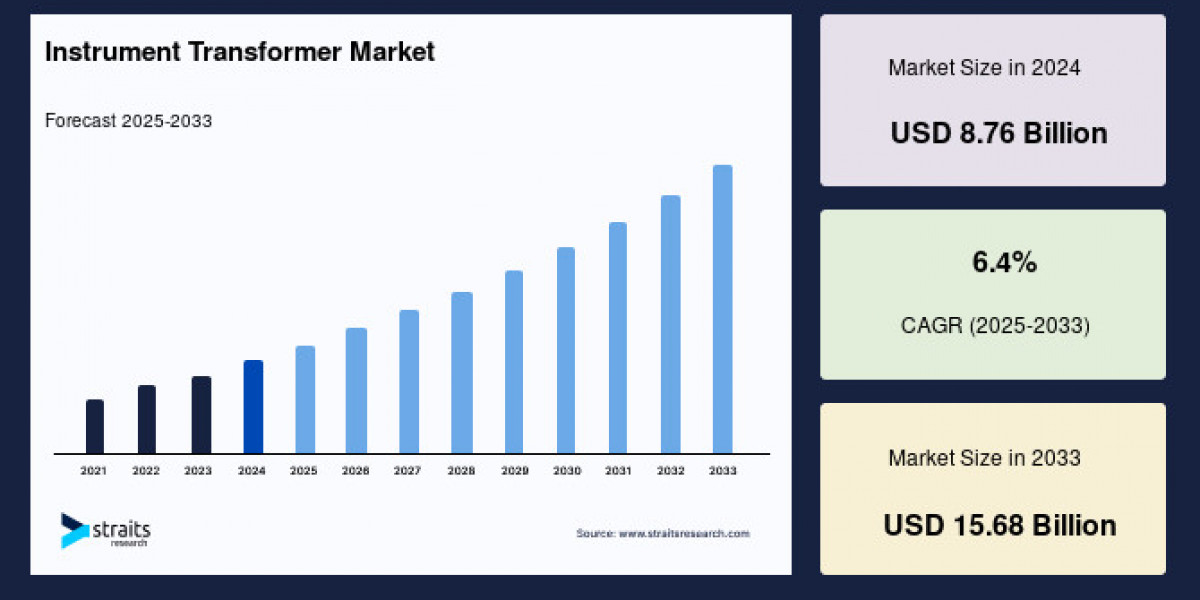

According to the latest research, the global instrument transformer market was valued at approximately USD 8.76 billion in 2024 and is projected to grow to around USD 15.68 billion by 2033, registering a steady CAGR of about 6.4% over the forecast period.

This growth is driven by rising electricity demand, infrastructure upgrades, smart grid adoption, and increasing investments in renewable energy transmission networks all of which require accurate measurement and protection systems.

Access Market Insights@ https://straitsresearch.com/report/instrument-transformer-market

Market Restraints

Despite healthy growth prospects, the instrument transformer market faces several restraints:

1. High Initial Investment:

Advanced and digital instrument transformers, especially those integrated with IoT and AI capabilities, carry higher upfront costs. Utilities in price-sensitive regions remain cautious about adopting these next-generation devices due to the capital expenditure required for implementation and system integration.

2. Legacy Infrastructure Compatibility Issues:

Integrating modern digital instrument transformers into older grid systems can be complex and costly, requiring additional retrofitting and system upgrades. Many utilities delay modernization due to these technical challenges.

3. Market Fragmentation and Price Competition:

The instrument transformer landscape includes a mix of global conglomerates and regional manufacturers. Intense competition, especially from lower-cost suppliers in emerging economies, can compress margins for established players.

Download Your Sample Report Now@ https://straitsresearch.com/report/instrument-transformer-market/request-sample

Market Opportunities

1. Digital Substation Expansion:

With global grid modernization initiatives underway, utilities and developers are increasingly adopting digital substations. These advanced systems use instrument transformers with embedded sensors, real-time communication and analytics, enhancing grid reliability, safety and performance.

2. Renewable Energy Integration:

The surge in wind, solar and hybrid energy projects demands high-accuracy measurement devices to ensure safe and efficient integration into transmission networks. Compact, maintenance-free instrument transformers tailored for renewable infrastructure present a significant growth opportunity.

3. Service-Oriented Solutions:

Providers offering lifecycle services including analytics dashboards, predictive maintenance and software-enabled monitoring solutions are gaining traction. This shift from pure hardware supply to integrated solutions creates recurring revenue potential.

4. Regional Expansion in Developing Economies:

Emerging markets such as Southeast Asia, Latin America, and parts of Africa are investing heavily in electrification, rural grid expansion and infrastructure upgrades. This trend opens new avenues for instrument transformer deployments.

Available for purchase with detailed segment data, forecasts, and regional insights. Buy now@ https://straitsresearch.com/buy-now/instrument-transformer-market

Segmentation Overview

The instrument transformer market can be segmented into multiple categories based on type, application, dielectric medium, installation, voltage, end-user, and region:

By Type

Current Transformers (CTs)

Potential (Voltage) Transformers (PTs)

Combined Instrument Transformers

By Application

Transformer & Circuit Breaker Bushing

Switchgear Assemblies

Relaying

Metering & Protection

By Dielectric Medium

Liquid Dielectric Transformers

SF₆ Gas Dielectric Transformers

Solid Dielectric Transformers

By Enclosure

Indoor

Outdoor

By Voltage

Distribution Voltage

Sub-Transmission

High Voltage

Extra-High & Ultra-High Voltage

By End-Users

Power Utilities

Power Generation

Railways and Metros

Industries & OEMs

By Region

North America

Europe

Asia-Pacific (dominant region)

Latin America

Middle East & Africa

The Asia-Pacific region currently leads the market with the largest share, driven by rapid urbanization, infrastructure investments and the shift toward smart grid technologies in countries like China, India and Japan.

Key Players With Revenue Insights

The instrument transformer market features a somewhat fragmented but competitive landscape wherein global power equipment leaders coexist alongside regional specialists.

Some of the major players include:

ABB Ltd A leading supplier with broad digital transformer portfolios and bundled grid automation solutions.

Siemens Energy / Siemens AG Known for digital substations and smart transformer offerings.

General Electric (GE) Supplies high-precision instrument transformers globally.

Schneider Electric Focuses on IoT-enabled and AI-driven monitoring transformers.

Hitachi Energy Expanding production and components tailored for modern grids.

Arteche Developer of compact and high-density instrument transformer units.

Others: BHEL, CG Power, Mitsubishi Electric, Nissin Electric, Pfiffner Group, WEG, CHINT Group and regional manufacturers.

Although detailed revenue figures vary by fiscal year, top players such as ABB, Siemens and GE alone accounted for a significant portion of 2024 market shipments.

Latest Developments & Collaborations

The market has seen notable product innovations, partnerships and capacity expansions in recent years:

Siemens Energy launched digital current transformers optimized for urban and medium-voltage applications in 2024.

ABB expanded its smart substation offerings with bundled digital CT/VT solutions.

Arteche introduced ultra-compact combined instrument transformers for emerging markets.

Schneider Electric partnered with utilities in Southeast Asia on AI-enabled grid analytics pilot programs.

GE Vernova debuted a predictive maintenance-focused VT series for North America.

Strategic investments, joint ventures and manufacturing expansions like Hitachi Energy’s capacity boosts and collaborative ventures are reshaping industry dynamics.

Frequently Asked Questions (FAQs)

Q1. What is the current size of the instrument transformer market?

A1. The global instrument transformer market was valued at approximately USD 8.76 billion in 2024.

Q2. What is the expected growth rate through 2033?

A2. The market is projected to grow at a CAGR of around 6.4% from 2025 to 2033.

Q3. Which region leads the market?

A3. Asia-Pacific holds the largest share, driven by grid expansions and smart infrastructure investments.

Q4. Who are the key competitors in the market?

A4. Prominent players include ABB, Siemens Energy, GE, Schneider Electric, Hitachi Energy, Arteche, BHEL, CG Power, Mitsubishi Electric, Nissin Electric and others.

Q5. What are the major trends shaping the industry?

A5. Key trends include digital instrument transformers, IoT/AI integration for predictive maintenance, compact designs for urban grids, and eco-friendly insulation materials.

Conclusion

The Instrument Transformer Market is poised for sustained expansion driven by global electrification efforts, renewable energy integration, smart grid modernization and technology innovation. While challenges like high initial costs and compatibility issues with legacy infrastructure persist, opportunities abound in digitalization, service-oriented solutions and emerging regional demand. As utilities and grid operators require more precise, connected and reliable measurement systems, instrument transformer manufacturers that innovate with advanced features, scalable platforms and integrated services are best positioned to capitalize on the evolving landscape.