Market Overview:

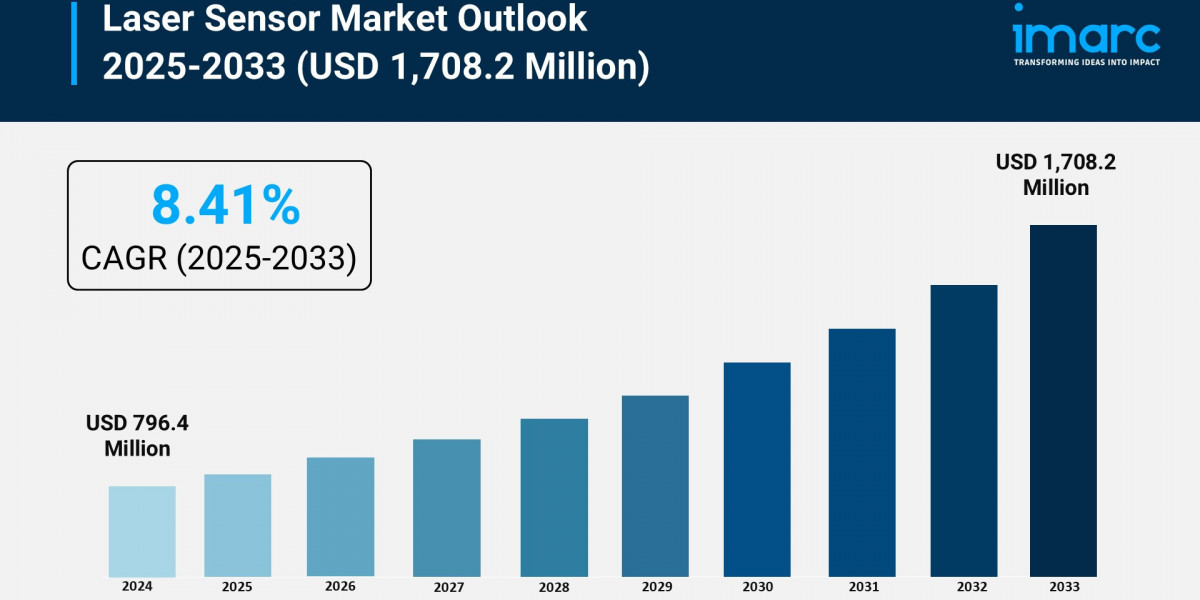

According to IMARC Group's latest research publication, "Laser Sensor Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global laser sensor market size reached USD 796.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,708.2 Million by 2033, exhibiting a growth rate (CAGR) of 8.41% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Laser Sensor Market

AI integration enables laser sensors to deliver real-time data analysis and predictive maintenance, with 38% of newly deployed sensors featuring AI-based signal processing that improves defect detection accuracy by 28-35%.

Smart manufacturing initiatives leverage AI-powered laser sensors across 90+ countries, reducing inspection errors by approximately 28% and significantly improving yield rates on high-speed production lines.

Companies integrate laser sensors with IoT platforms and AI technologies, creating intelligent systems for automated process control, with over 64% of sensors now supporting industrial Ethernet protocols for real-time monitoring.

Advanced AI algorithms enhance laser sensor capabilities in autonomous vehicles and robotics, enabling precise object detection and navigation with measurement accuracy below ±1 micron in precision manufacturing applications.

Industry 4.0 adoption drives AI-enabled laser sensor deployment in quality control systems, with 3D laser profiling representing 29% of industrial inspection installations for high-precision surface mapping.

Download a sample PDF of this report: https://www.imarcgroup.com/laser-sensor-market/requestsample

Key Trends in the Laser Sensor Market

Integration with AI and IoT Technologies: The market is experiencing rapid adoption of smart laser sensors, with over 38% integrating AI-based signal processing for enhanced data analytics. These intelligent systems enable real-time monitoring and predictive maintenance, reducing downtime by up to 28% in automated production environments. Connectivity improvements allow 64% of laser sensors to support Ethernet-based industrial protocols with data latency below 5 milliseconds.

Miniaturization and Compact Design Innovation: Manufacturers are developing ultra-compact sensors with 22% reduction in device volume, enabling deployment in space-constrained robotic cells and electronics manufacturing. Recent launches like Keyence's ultra-compact laser sensors in April 2023 deliver unmatched precision in applications requiring installation spaces below 150 millimeters, solidifying market position in semiconductor industries.

High-Speed and High-Resolution Advancements: Between 2023-2025, 49% of newly launched sensors achieved resolution improvements of approximately 30%, with measurement accuracy below ±1 micron. Omron's HLS-S series launched in February 2024 offers micron-level accuracy and measurement speeds up to 40 kHz, meeting market demands for faster and more precise industrial measurement solutions.

Renewable Energy Applications Expansion: Investment in renewable energy projects reached $358 billion in H1 2023, a 22% increase from 2022. Laser sensors provide critical precision data for monitoring wind turbines, solar panel alignment, and biomass measurement, with renewable energy companies raising $10.4 billion in equity commitments, up 25% year-over-year.

Non-Contact Sensing Demand Growth: Industries increasingly adopt non-contact laser measurement technologies for fragile or inaccessible products, with applications spanning healthcare, automotive, and manufacturing. These sensors offer superior accuracy for quality control while eliminating physical contact risks, supporting sustainability and precision manufacturing goals across diverse sectors.

Growth Factors in the Laser Sensor Market

Automation in Manufacturing Surge: Over 63% of manufacturers have integrated automation technologies, with 75% reporting 10-12% productivity boosts. Automation reduces waste by up to 30% and cuts downtime by 20%, driving demand for laser sensors that ensure precise component positioning and assembly in highly automated environments.

Technological Advancements and R&D Investment: Between 2023-2025, investment in advanced sensing technologies increased by 51%, with 44% of budgets allocated to automation-focused R&D. Asia-Pacific manufacturing output for laser sensors grew 36%, supported by electronics and automotive production hubs seeking precision measurement solutions.

Robotics and Autonomous Systems Expansion: Approximately 3.4 million industrial robots deployed globally require laser sensors for precise position feedback, safety, and movement enhancement. LiDAR technology secured major contracts like Aeva's multiyear deal with Daimler Truck for autonomous Freightliner Cascadia trucks, with production starting in 2026.

Industry 4.0 and Smart Factory Adoption: Smart manufacturing practices drive laser sensor integration for quality control and process optimization. Companies leverage sensors with edge computing capabilities for machine-to-machine communication, with 90+ countries prioritizing sensor-based quality control in smart factory initiatives.

Precision Measurement in Quality Control: Industries demand sensors with sampling frequencies exceeding 30 kHz for real-time inspection on production lines moving faster than 2 meters per second. Enhanced environmental protection features like IP67-rated enclosures ensure reliable operation in challenging industrial environments with dust, moisture, and vibrations.

Leading Companies Operating in the Global Laser Sensor Industry:

Baumer Electric AG

First Sensor AG (TE Connectivity Ltd.)

IFM Electronic GmbH

Keyence Corporation

Laser Technology Inc.

Micro-Epsilon Messtechnik GmbH & Co. KG

MTI Instruments Inc. (Mechanical Technology Incorporated)

OMRON Corporation

Optex Co. Ltd.

Panasonic Corporation

Rockwell Automation Inc.

Schmitt Industries Inc

SmartRay GmbH

Laser Sensor Market Report Segmentation:

Breakup By Type:

Compact

Ultra-Compact

Compact accounts for the majority of shares due to their versatility, ease of integration, and wide range of applications across consumer electronics, automotive, and medical devices.

Breakup By Component:

Hardware and Software

Services

Hardware and software dominates the market, providing foundational capabilities through laser diodes, photodetectors, and signal processors, enhanced by advanced software algorithms for real-time data processing and calibration.

Breakup By Application:

Security and Surveillance

Motion and Guidance

Process Monitoring and Quality Control

Distance Measurement

Manufacturing Plant Management

Others

Security and surveillance represents the leading segment, driven by increasing need for advanced security solutions in commercial buildings, public spaces, and critical infrastructure with high-precision detection capabilities.

Breakup By End User:

Automotive

Aerospace and Defense

Food and Beverages

Consumer Electronics

Chemical

Healthcare

Others

Food and beverages exhibits clear dominance, with laser sensors extensively used for level measurement, quality inspection, packaging verification, and sorting to ensure safety and efficiency in production processes.

Breakup By Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position owing to advanced technological infrastructure, strong presence of major industry players, and significant R&D investments supporting automation adoption across automotive, aerospace, healthcare, and manufacturing sectors.

Recent News and Developments in Laser Sensor Market

April 2023: Keyence Corporation announced the release of a new line of ultra-compact laser sensors designed to deliver unmatched precision in space-constrained applications, solidifying its position in the electronics and semiconductor industries with enhanced capabilities for high-accuracy measurement.

February 2024: Omron Corporation launched the HLS-S series of high-speed and high-resolution laser displacement sensors, offering micron-level accuracy and measurement speeds of up to 40 kHz, addressing market demands for faster and more precise industrial measurement solutions.

February 2024: Rockwell Automation introduced the Allen-Bradley Bulletin 5000 LDX laser distance sensor series for long-range measurement applications requiring high precision, featuring measurement range up to 10 meters with accuracy of ±2 mm for demanding industrial applications.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302