However, before choosing an offshore accounting partner, US firms need to consider several critical factors to ensure quality, compliance, and long-term success.

Understanding Offshore Accounting Services

Offshore accounting services encompass a wide range of financial functions, including bookkeeping, payroll processing, accounts receivable and payable management, financial reporting, tax preparation support, and audit assistance. By delegating these tasks to an offshore team, US firms can focus on strategic initiatives, client engagement, and growth without overloading in-house resources.

Assessing the Cost-Benefit Analysis

Cost reduction is often the primary reason firms look offshore. Offshore accounting services can provide significant savings on salaries, benefits, infrastructure, and software costs. However, US firms must conduct a thorough cost-benefit analysis to weigh savings against potential risks, such as communication challenges, time zone differences, or initial training and onboarding costs. A clear understanding of projected ROI helps firms make informed decisions.

Evaluating Experience and Expertise

Not all offshore accounting providers are created equal. US firms should evaluate a provider’s experience with US accounting standards, including US GAAP, PCAOB requirements, and IRS regulations. Providers should have trained professionals who understand the nuances of US financial reporting, tax compliance, and audit requirements. Experience with US-based clients is a strong indicator that the offshore provider can deliver accurate, compliant, and timely accounting services.

Ensuring Data Security and Confidentiality

Data security is a critical concern when outsourcing financial services offshore. Firms must verify that the offshore provider has robust security protocols, including encrypted data transfers, secure servers, multi-factor authentication, and access controls. Non-disclosure agreements (NDAs) and compliance with international standards such as ISO 27001 add additional protection. Ensuring strict confidentiality protects sensitive financial information and mitigates the risk of data breaches.

Defining Scope of Work and Responsibilities

Clear definition of responsibilities is essential for a successful offshore partnership. US firms should outline which tasks are to be handled offshore and which require in-house oversight. Routine bookkeeping, reconciliations, and report preparation can be effectively managed offshore, while final reviews, strategic decisions, and sign-offs should remain with licensed US professionals. Proper role segregation ensures accountability and compliance with regulatory standards.

Communication and Collaboration

Effective communication is a key factor in offshore accounting success. Time zone differences, language barriers, and cultural nuances can impact collaboration. US firms should establish regular communication channels, use project management tools, and schedule periodic video meetings to maintain alignment. Clear documentation of processes, expectations, and deadlines reduces errors and improves workflow efficiency.

Compliance with US Regulations

Maintaining compliance with US accounting and tax regulations is non-negotiable. US firms must ensure that offshore providers adhere to US GAAP, GAAS, IRS guidelines, and other applicable standards. Documentation of outsourced tasks, regular reviews, and adherence to audit trail requirements are essential. Providers should also stay updated with changes in US regulations to ensure continued compliance.

Quality Control and Oversight

Regular quality checks and supervision are crucial when working with offshore accounting teams. US firms should implement review processes, standardized checklists, and internal audits to maintain accuracy and consistency. Some firms rotate offshore personnel periodically or conduct random audits to ensure high-quality deliverables. Continuous monitoring helps identify errors early and reinforces accountability.

Legal and Contractual Safeguards

Contracts with offshore accounting providers should be detailed and comprehensive. Service-level agreements (SLAs) should specify deliverables, timelines, accuracy standards, data security requirements, and escalation procedures. Legal clauses for confidentiality, intellectual property protection, and regulatory compliance safeguard the firm against potential risks. Well-structured contracts create clarity and build trust between the US firm and the offshore provider.

Scalability and Flexibility

One of the major advantages of offshore accounting services is scalability. Firms can adjust team size based on seasonal workloads, audit cycles, or business growth. Offshore providers should be able to quickly scale resources up or down without compromising quality. Flexibility in staffing allows US firms to handle increased volumes efficiently and cost-effectively.

Choosing the Right Offshore Partner

Selecting the right offshore accounting partner involves evaluating several factors: experience with US clients, technical expertise, data security protocols, compliance knowledge, communication capabilities, and cost-effectiveness. References, client testimonials, and trial projects can provide insights into the provider’s performance. A long-term partnership approach, rather than a transactional mindset, usually results in better outcomes and stronger collaboration.

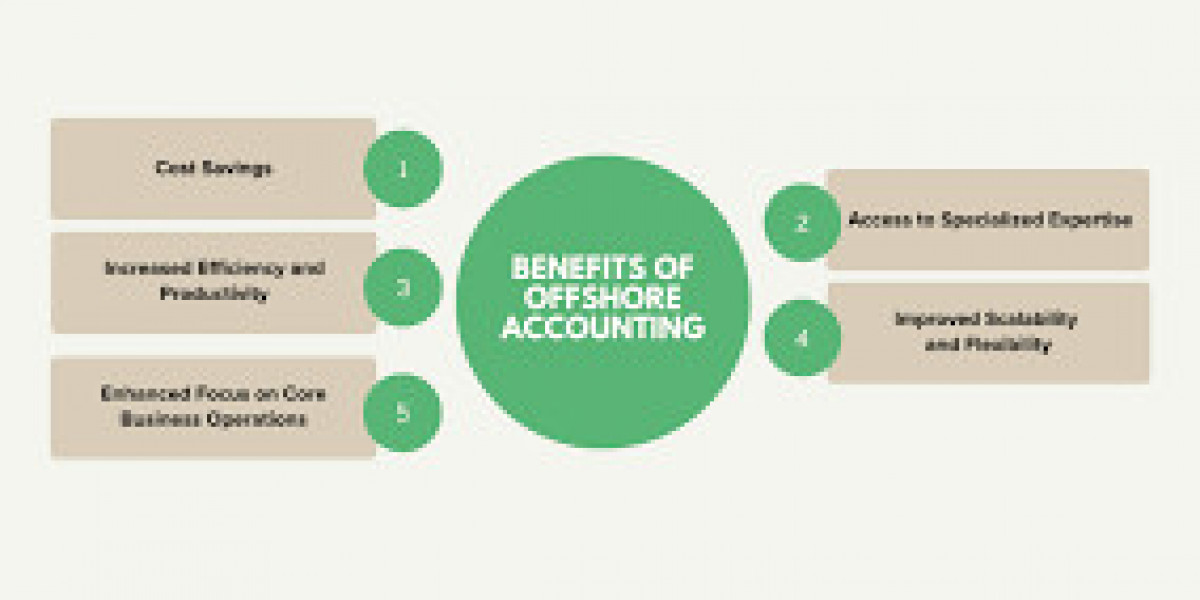

Benefits of Offshore Accounting Services

When chosen carefully, offshore accounting services offer multiple benefits:

Cost Savings: Lower labor and operational costs without compromising quality.

Access to Expertise: Skilled professionals familiar with US accounting standards.

Improved Efficiency: Faster turnaround times and round-the-clock operations.

Scalability: Ability to expand resources during peak periods.

Focus on Strategic Work: US teams can concentrate on advisory and growth activities.

Conclusion

Offshore accounting services can provide US firms with a strategic advantage, but success depends on careful planning and selection. Understanding the provider’s expertise, ensuring compliance, implementing robust security measures, and maintaining effective communication are critical. With the right offshore partner, US firms can achieve cost savings, operational efficiency, and scalability while maintaining high standards of accuracy and regulatory compliance. By taking a structured approach, offshore accounting can become a reliable extension of a US firm’s finance team.