IMARC Group, a leading market research company, has recently released a report titled "automotive wrap films market share, size, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the automotive wrap films market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Market Overview

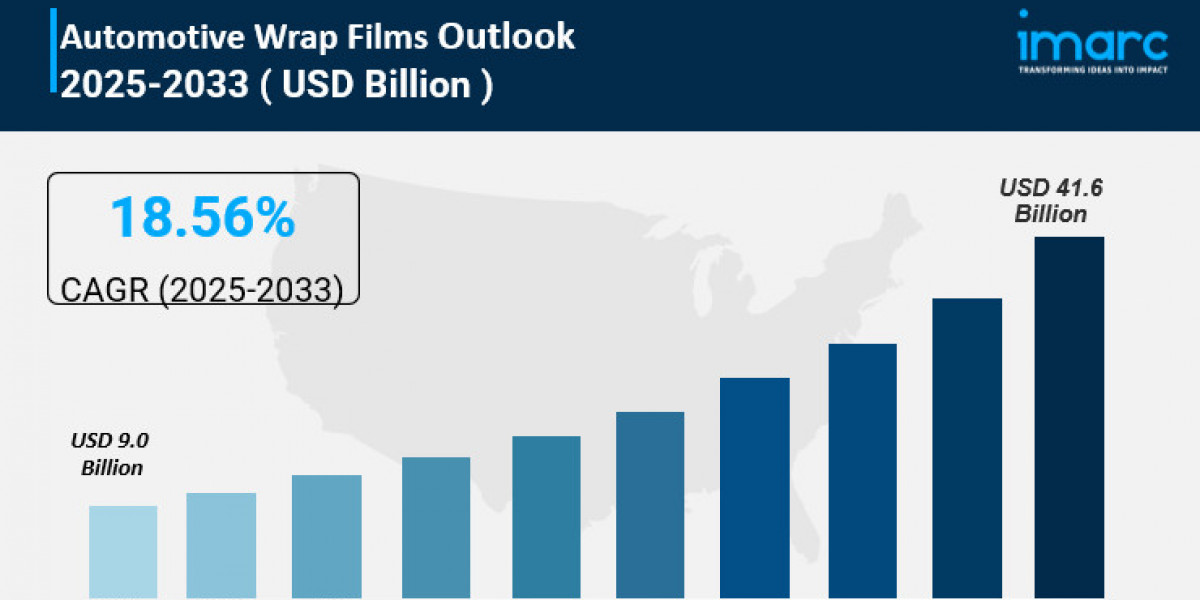

The global automotive wrap films market was valued at USD 9.0 Billion in 2024 and is projected to reach USD 41.6 Billion by 2033, exhibiting a CAGR of 18.56% during the forecast period of 2025-2033. North America dominated with over 35.8% market share in 2024, driven by growing demand for vehicle customization, advanced technologies, and strategic mergers. The market is also fueled by innovations like self-healing films and increasing use of wraps for branding.

Study Assumption Years

● Base Year: 2024

● Historical Years: 2019-2024

● Forecast Period: 2025-2033

Automotive Wrap Films Market Key Takeaways

● Current Market Size: USD 9.0 Billion (2024)

● CAGR: 18.56%

● Forecast Period: 2025-2033

● North America led the market with over 35.8% share in 2024.

● Passenger cars hold approximately 54.0% of the market share in 2024.

● Innovations like self-healing and eco-friendly films are driving market growth.

● Increasing demand for vehicle customization and commercial branding fuels adoption.

● Strategic mergers and acquisitions are expanding market capabilities.

Claim Your Free "Footwear Market" Insights Sample PDF: https://www.imarcgroup.com/automotive-wrap-films-market/requestsample

Market Growth Factors

The automotive wrap films market growth is largely driven by a rising demand for vehicle customization, as customers prefer affordable alternatives to traditional paint jobs. Wrap films offer a variety of finishes such as matte, metallic, gloss, satin, and textured types which allow unique and personalized vehicle designs. Commercial fleets also utilize wrap films for branding and advertising, due to cost-effectiveness compared to repainting. A 3M study highlights that fleet graphics deliver about 6 million impressions per truck per year at a low cost of USD 0.48 per thousand impressions, indicating an effective advertisement medium that boosts market growth.

Surging electric vehicle (EV) adoption presents significant opportunities for the automotive wrap films market. In 2023, U.S. EV sales exceeded 1.4 million units, rising from 800,000 in 2022, according to the U.S. Department of Energy. EV owners favor customization that matches the vehicles' futuristic identity. Wrap films aid in differentiating EVs on roads while promoting eco-friendly branding. Alongside governmental worldwide incentives for EV uptake, manufacturers are developing eco-friendly films to meet environmentally conscious consumers’ needs, further expanding the market.

Technological advancements in wrap films bolster market demand by enhancing durability and aesthetics. About 15% of vehicle wraps in the U.S. incorporated self-healing technology by 2023, offering scratch resistance and protection against UV rays and extreme weather. Innovations feature thinner yet tougher films that reduce production costs and simplify application. Moreover, advances in printing technology enable complex designs and textures, while biodegradable and recyclable films address environmental concerns, collectively fueling growth as consumers seek sustainable, high-performance and visually appealing products.

Market Segmentation

By Film Type:

● Windows Films: Dominate the market due to aesthetic and practical benefits like UV protection, heat reduction, and privacy. Advanced versions offer scratch resistance and durability. Regulatory support and cost-effectiveness enhance adoption among individual owners and fleet operators.

● Wrap Films: Popular for vehicle customization with a variety of finishes, offering flexibility and protection against damages.

● Paint Protection Films: Provide surface protection but hold smaller market share than window films and wrap films.

By Vehicle Type:

● Passenger Cars: Lead the segment with a 54.0% market share in 2024 due to rising personalization demand and ability to protect vehicle exteriors, increasing resale value. Also favored for low-cost advertising wraps.

● Light Commercial Vehicles: Used for durable wraps suitable for commercial branding and protection.

● Heavy Commercial Vehicles: Demand driven by fleet branding and protective solutions.

Regional Insights

North America dominates the automotive wrap films market with over 35.8% market share in 2024. This leadership is due to high consumer demand for customization, robust automotive industry presence, and prevalent use of wrap films for advertising. Strategic innovations by key manufacturers and awareness of protection from environmental damage also support growth. The U.S. contributes 85.00% of North America’s revenue, fueled by 10.6 million vehicle production units in 2023 and 15.5 million light vehicle sales, promoting wrap films for personal and commercial use.

Recent Developments & News

● October 2024: ORAFOL acquired a stake in Group M.A.M., a Belgian film manufacturer, aiming for full ownership and expanding climate protection solutions with production commencing at Oranienburg in 2025.

● September 2024: Avery Dennison launched the Bright Escapes Supreme Wrapping Film collection featuring vibrant colors with Easy Apply RS adhesive technology.

● September 2024: Spandex partnered with KPMF to release the KPMF VWS IV series offering over 100 colors, four finishes, and up to seven years durability.

● June 2024: 3M continued as a key automotive partner providing innovative design solutions including wrap films.

● June 2024: Avery Dennison announced launch of eco-friendly SP 1504 Easy Apply RS digital print film in Australia and New Zealand, reducing greenhouse emissions by 53% compared to traditional PVC films.

● March 2024: Arlon Graphics introduced VITAL non-PVC wrap films focusing on quality, durability, and sustainability.

Key Players

● 3M Company

● Arlon Graphics LLC (Flexcon Company Inc.)

● Avery Dennison Corporation

● Hexis S.A.S

● Kay Premium Marking Films Ltd.

● Madico Inc. (LINTEC Corporation)

● ORAFOL Europe GmbH

Ask an Analyst : https://www.imarcgroup.com/request?type=report&id=7079&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302