IMARC Group, a leading market research company, has recently released a report titled " Battery Materials Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Battery Materials market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Market Overview

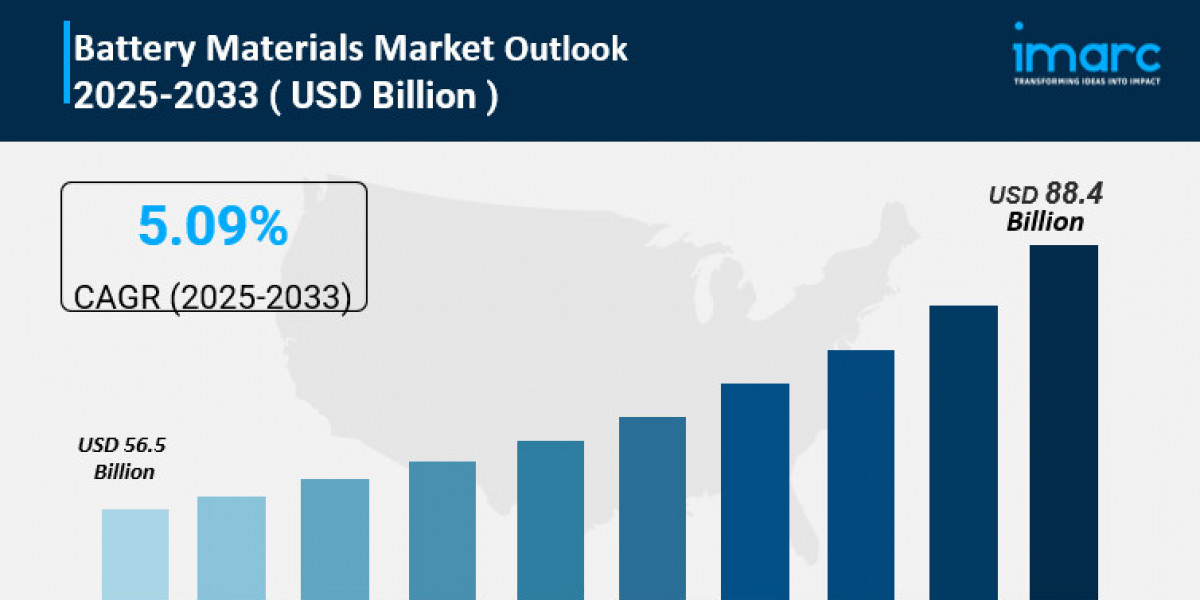

The global Battery Materials Market size was valued at USD 56.5 Billion in 2024. It is projected to reach USD 88.4 Billion by 2033, growing at a CAGR of 5.09% during the forecast period 2025-2033. This growth is driven by the increasing focus on electric mobility initiatives, industrial automation trends, carbon emissions reduction efforts, and advancements in solid-state battery production.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Battery Materials Market Key Takeaways

● Current Market Size: USD 56.5 Billion (2024)

● CAGR: 5.09% (2025-2033)

● Forecast Period: 2025-2033

● Major drivers include growing adoption of electric vehicles (EVs) and rising demand for renewable energy storage.

● Asia Pacific dominates the market due to strong industrial infrastructure and government support.

● Cathode material segment leads the market by type.

● Lithium-ion batteries hold the largest market share by battery type.

● Automobile industry accounts for the majority market share by application.

Sample Request Link: https://www.imarcgroup.com/battery-materials-market/requestsample

Market Growth Factors

The global battery materials market is propelled by the escalating adoption of electric vehicles (EVs), largely driven by stringent emissions regulations, increased environmental concerns, and sustainable transportation initiatives. Governments worldwide are enhancing charging infrastructure, encouraging manufacturers to invest intensively in EV technologies. This has resulted in rising demand for high-capacity lithium-ion batteries, which require substantial quantities of critical materials, including lithium, nickel, and cobalt. The automotive sector's transition toward reducing carbon emissions amplifies this growth by necessitating advanced sustainable battery technologies.

The increasing demand for portable electronics significantly fuels the battery materials market. The proliferation of handheld devices, such as smartphones and IoT devices (smartwatches, fitness trackers, wireless earbuds), drives the need for batteries with longer life, lighter weight, and faster recharge capabilities. This consumer expectation pushes manufacturers to innovate in battery materials and technologies. Expanding portable electronics markets in emerging regions further catalyze demand for advanced battery materials globally.

Renewable energy integration presents an essential growth driver as solar and wind power adoption rises worldwide. Efficient energy storage solutions are necessary to manage the intermittency of these renewable sources and stabilize grid supply. Favorable government policies, rebates, and investments in energy infrastructure accelerate this trend. Utility companies are actively seeking to enhance grid robustness and reduce fossil fuel dependency, prompting greater requirements for advanced battery materials that support reliable energy storage systems.

Market Segmentation

Breakup by Type:

● Cathode

● Anode

● Electrolyte

● Separator

● Others

Cathode dominates the market as it crucially influences battery performance, capacity, and lifespan. Lithium-ion batteries for EVs and handheld devices rely heavily on cathode materials such as lithium, nickel, cobalt, and manganese, which affect energy density and power output, driving continual improvements in performance and efficiency.

Breakup by Battery Type:

● Lithium Ion

● Lead Acid

● Others

Lithium-ion batteries hold the largest share, attributed to their high energy density, light weight, and long cycle life. Their growing use in electric vehicles, consumer electronics, and renewable energy storage underpins this dominance.

Breakup by Application:

● Automobile Industry

● Household Appliances

● Electronics Industry

● Others

The automobile industry leads in application owing to the surge in electric and hybrid vehicle adoption. Increased investments in advanced battery technologies and government incentives further reinforce this segment’s market share.

Breakup by Region:

● North America

● United States

● Canada

● Asia-Pacific

● China

● Japan

● India

● South Korea

● Australia

● Indonesia

● Others

● Europe

● Germany

● France

● United Kingdom

● Italy

● Spain

● Russia

● Others

● Latin America

● Brazil

● Mexico

● Others

● Middle East and Africa

Regional Insights

Asia Pacific is the dominant region in the global battery materials market, accounting for the largest market share. This leadership is due to strong industrial infrastructure, government incentives for energy storage and EVs, and the presence of major battery manufacturers. Countries including China, Japan, and South Korea advance innovative battery technologies and enjoy access to key raw materials, driving the region's competitive advantage and market revenue growth.

Recent Developments & News

In June 2025, Intercontinental Exchange (ICE) launched futures contracts for key battery materials such as lithium hydroxide, lithium carbonate, cobalt, and spodumene, backed by Fastmarkets’ pricing to enhance risk management amid geopolitical shifts. In April 2025, China’s CATL introduced the sodium-ion battery brand "Naxtra" and a fast-charging EV battery promising a 520 km range with rapid charging. Also, Panasonic Energy and Sumitomo Metal Mining began a nickel recycling project aiming to provide 20% recycled cathode material in EV batteries by 2030. Notable agreements include Albemarle Corporation's multi-year lithium supply deal with BMW Group starting in 2025 and Asahi Kasei's plans for a lithium-ion battery separator plant in Canada announced in April 2024. BASF partnered with SK On to explore lithium-ion battery market opportunities in North America and Asia-Pacific as of November 2023.

Key Players

● Albemarle Corporation

● Asahi Kasei Corporation

● BASF SE

● Entek International Ltd.

● Johnson Matthey

● Livent

● Mitsubishi Chemical Holdings Corporation

● Nichia Corporation

● Showa Denko K. K.

● Sumitomo Chemical Co. Ltd.

● Targray Technology International Inc.

● Umicore N.V.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302