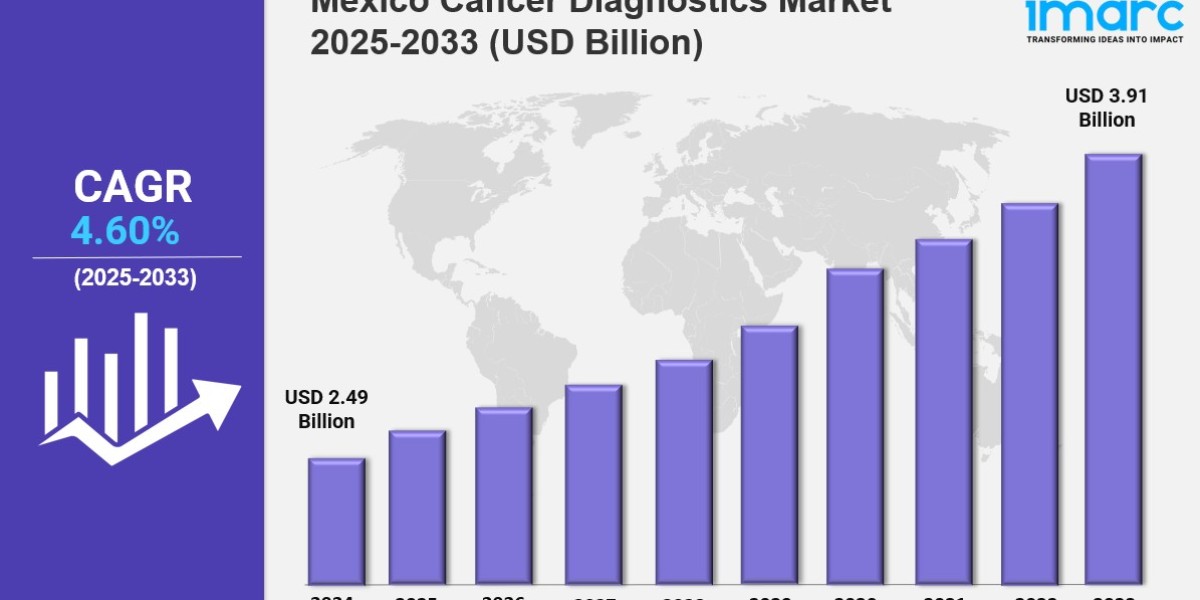

Market Overview 2025-2033

The Mexico cancer diagnostics market size reached USD 2.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.91 Billion by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The Mexico cancer diagnostics market is growing due to rising cancer prevalence, increased awareness, and demand for early detection. Growth is driven by advanced diagnostic technologies, government initiatives, and expanding healthcare infrastructure, making the industry more dynamic, accessible, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising cancer prevalence and early detection awareness

✔️ Increasing adoption of advanced imaging and biomarker-based diagnostic tools

✔️ Expanding government initiatives and investment in healthcare infrastructure and screening programs

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-cancer-diagnostics-market/requestsample

Mexico Cancer Diagnostics Market Trends and Driver:

The Mexico cancer diagnostics market is undergoing rapid transformation, driven by rising cancer incidence due to aging demographics, lifestyle-related risk factors (such as tobacco use and processed diets), and environmental exposures. Breast, prostate, and cervical cancers remain the most prevalent, placing immense pressure on public healthcare infrastructure. Demand for early detection tools is rising sharply, yet stark disparities persist—urban hubs like Mexico City offer cutting-edge imaging and molecular diagnostics, while rural clinics often lack even basic screening capabilities. The government’s 2023 National Cancer Plan attempts to close this gap, though funding constraints continue to limit implementation.

As a result, private-sector partnerships with international firms like Roche and Siemens are playing a key role in advancing access to genomic profiling and liquid biopsy technologies. Despite a 20% increase in HPV and lung cancer screenings in 2024, late-stage diagnosis still affects over 60% of patients, signaling major unmet needs and untapped opportunities within the mexico cancer diagnostics market size. Technological advancements are reshaping the landscape, with AI-powered imaging and digital pathology gaining momentum. Post-pandemic telemedicine expansion has accelerated adoption of AI algorithms that now reduce radiologist workloads by up to 30%, improving diagnostic throughput in resource-constrained hospitals. Startups like MedAI-MX have partnered with public institutions to deploy cloud-based diagnostic platforms in underserved regions. However, limited compatibility with older equipment and cybersecurity concerns hinder nationwide scalability.

In 2024, regulatory approvals surged for innovations such as PET-MRI and circulating tumor DNA tests. Private laboratories continue to lead high-end tech adoption, while public institutions often depend on donor-funded pilots. The high cost of genomic testing—averaging $1,200—remains prohibitive for nearly half the population, spurring interest in affordable, locally developed alternatives. These shifts are expected to further expand the Mexico cancer diagnostics market share, particularly as domestic solutions scale.

Investment activity is increasingly focused on hybrid public-private models, blending government subsidies with private-sector innovation. Under the 2023–2028 Health Infrastructure Fund, $500 million has been allocated to upgrade oncology hubs, although bureaucratic slowdowns remain a challenge. Meanwhile, private equity investment grew 35% in 2024, particularly targeting precision oncology labs like Grupo Diagnóstico Aries. Mexico’s manufacturing capacity offers strategic advantages, with local production of immunoassay reagents cutting import costs by 25%. However, unresolved tariff disputes and fragile supply chains continue to threaten reagent availability. Advocacy groups are also pressuring for regulatory pricing reform, citing monopolistic practices in biomarker testing.

Emerging startups focused on rapid, low-cost cancer diagnostics are drawing venture capital interest, but scaling remains dependent on navigating COFEPRIS's complex approval framework. These evolving dynamics are shaping both the Mexico cancer diagnostics market size and its competitive landscape.

Despite major advancements, the Mexico cancer diagnostics market still faces systemic challenges rooted in healthcare inequity, regulatory complexity, and economic volatility. Cancer prevalence is projected to rise by 50% by 2030, with mortality rates exacerbated by delayed diagnosis. Public institutions like IMSS and ISSSTE struggle with fragmented service delivery; urban regions benefit from immunohistochemistry and flow cytometry capabilities, while rural areas still rely on basic cytology methods. The 2024 regulatory overhaul by COFEPRIS—streamlining AI diagnostic approvals—has accelerated adoption of digital pathology, especially when paired with the Ministry of Health’s partnership with PAHO to standardize screening protocols. Nonetheless, inconsistent funding hinders sustained implementation. Market growth is also influenced by macroeconomic shifts.

The peso’s 15% depreciation in early 2024 inflated costs of advanced imaging like MRI and PET-CT, prompting providers to raise prices and reducing access. In response, companies such as Abbott and BD have ramped up domestic manufacturing, shortening lead times by 40% and fostering a skilled local workforce through tech-transfer initiatives. Public dissatisfaction with diagnostic wait times—averaging 90 days for biopsy results—has spurred a consumer shift toward private options, which now account for 55% of the Mexico cancer diagnostics market share as of 2024. This intensifying competition is led by major players like Laboratorio Polanco and Chopo. The future of the Mexico cancer diagnostics market lies in balancing technological innovation with accessibility. Regulatory approvals in 2024 catalyzed widespread adoption of liquid biopsies, offering non-invasive monitoring for common cancers like breast and colorectal.

AI has helped reduce false negatives in imaging by 22%, yet the digital divide persists: only 30% of public facilities have cloud-based diagnostic infrastructure. With elections on the horizon, future policy shifts could impact R&D incentives, making government support critical. Cost-effective multiplex assays and point-of-care devices are expected to drive market expansion toward a projected $1.2 billion by 2026. However, a shortage of molecular diagnostics professionals threatens sustainable growth. Closing this gap through education and culturally sensitive public health campaigns will be vital to reducing late-stage cancer diagnoses and propelling the Mexico cancer diagnostics market toward global parity.

Mexico Cancer Diagnostics Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product:

Consumables

Antibodies

Kits and Reagents

Probes

Others

Instruments

Pathology-based Instruments

Imaging Instruments

Biopsy Instruments

Breakup by Technology:

IVD Testing

Polymerase Chain Reaction (PCR)

In Situ Hybridization (ISH)

Immunohistochemistry (IHC)

Next-generation Sequencing (NGS)

Microarrays

Flow Cytometry

Immunoassays

Others

Imaging

Magnetic Resonance Imaging (MRI)

Computed Tomography (CT)

Positron Emission Tomography (PET)

Mammography

Ultrasound

Biopsy Technique

Breakup by Application:

Breast Cancer

Lung Cancer

Colorectal Cancer

Melanoma

Others

Breakup by End User:

Hospitals and Clinics

Diagnostic Laboratories

Others

Breakup by Region:

Northern Mexico

Central Mexico

Southern Mexico

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145