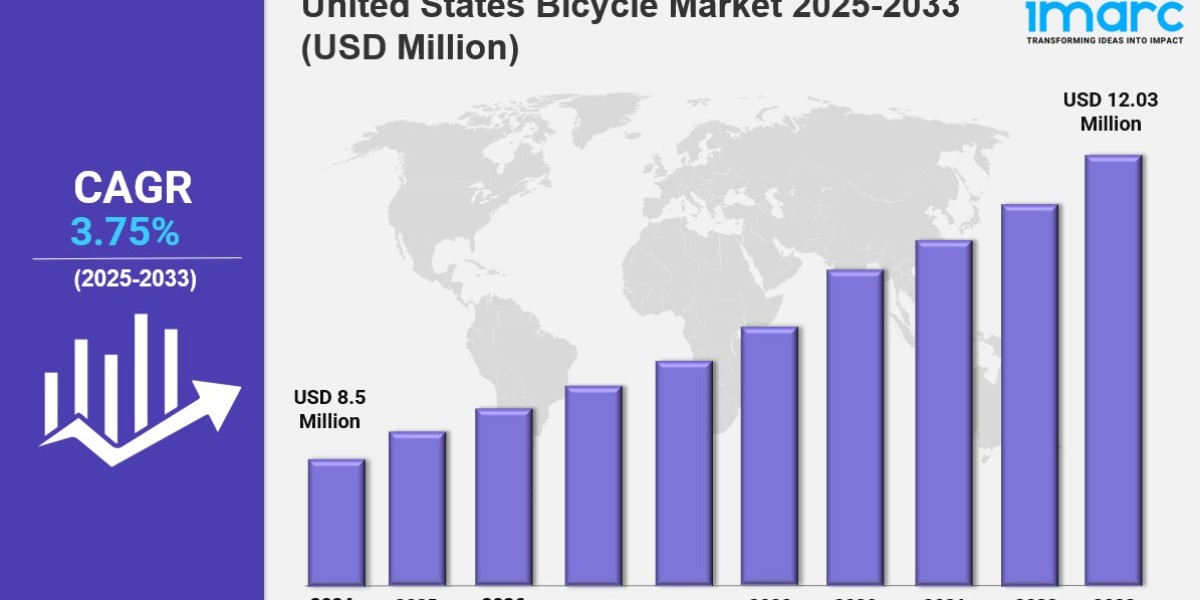

Market Overview 2025-2033

The United States bicycle market size was valued at USD 8.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.03 Million by 2033, exhibiting a CAGR of 3.75% from 2025-2033. The market is expanding due to rising health consciousness, urban mobility needs, and the popularity of eco-friendly transportation. Growth is driven by e-bike adoption, infrastructure investments, and digital retail channels, making the industry more dynamic, sustainable, and competitive.

Key Market Highlights:

✔️ Rising health awareness and eco-friendly commuting driving bicycle adoption

✔️ Surge in demand for e-bikes and connected cycling technologies

✔️ Government initiatives promoting cycling infrastructure and green transportation

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-bicycle-market/requestsample

United States Bicycle Market Trends and Drivers:

The United States bicycle market is undergoing major transformation, led by the rapid rise of electric bikes, which now account for more than 20% of total bike sales nationwide. This growth is fueled by urban commuters looking for quicker, more sustainable ways to get around, as well as older riders seeking comfortable alternatives to cars and public transit. Federal tax incentives and investments in protected bike lanes and charging infrastructure are making e-bikes more accessible. High-end models priced between $2,500 and $6,000 are driving the most revenue, while mid-range brands face ongoing challenges from supply disruptions and component tariffs.

New safety regulations around e-bike batteries, such as UL certification requirements, are also reshaping supply chains and pushing some manufacturers toward localized production. These changes have forced companies in the United States bicycle market to rethink where and how they build bikes. Tariff hikes on imports from China and Taiwan—ranging from 30% to 50% under Section 301—have pushed production to countries like Vietnam, Cambodia, and Mexico. Some brands are investing in U.S.-based micro-factories to handle higher-end or custom orders. Companies like Detroit Bikes and Allied Cycle Works are now handling about 15% of domestic mid-to-premium production, using automated systems and lean inventory strategies.

After severe port delays in 2024—caused by widespread strikes—many brands abandoned just-in-time logistics in favor of hybrid models that mix overseas mass production with domestic "build-to-order" flexibility. Meanwhile, the way people access bikes is changing. Traditional ownership is giving way to monthly subscription models, especially among Gen Z riders. Services like Swapfiets and Zoomo are gaining traction by offering flat-fee packages that include maintenance, theft coverage, and easy upgrades. These subscription-based models now make up around 8% of the urban cycling segment. Larger platforms like Lyft and Uber are also expanding their bike-share services and integrating them into public transit apps.

In response, brick-and-mortar bike shops are trying to hold their ground with loyalty programs, trade-in offers, and free tune-ups—but many still struggle to compete with tech-backed startups. As U.S. cities invest more in bike infrastructure and push toward climate targets, the United States bicycle market share is expanding beyond traditional demographics. Places like Minneapolis and Portland are allocating up to 7% of their transportation budgets to build multimodal corridors, linking bikes with rail, buses, and scooters. Adventure and gravel bikes are also having a moment, with total sales hitting $1.2 billion in 2024. Companies like Specialized are using AI-driven fitting tools to reduce returns and boost customer satisfaction.

The brief spike in lithium prices during mid-2024 caused e-bike prices to jump by 18%, prompting some manufacturers to explore sodium-ion batteries in partnership with institutions like MIT. At retail, the focus has shifted to experience—REI stores now feature VR trail simulators and pro-grade fitting labs—while direct-to-consumer brands offer virtual test rides through augmented reality apps. Still, safety remains a major hurdle: about 60% of potential riders say they avoid commuting by bike due to unsafe routes. In response, federal grants are now backing the development of over 3,000 miles of protected lanes by 2033, setting the stage for continued United States bicycle market growth in the years ahead.

United States Bicycle Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Type:

Road Bicycle

Mountain Bicycle

Hybrid Bicycle

Others

Analysis by Technology:

Electric

Conventional

Analysis by Price:

Premium

Mid-Range

Low-Range

Analysis by Distribution Channel:

Online

Offline

Analysis by End User:

Men

Women

Kids

Regional Analysis:

Northeast

Midwest

South

West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145