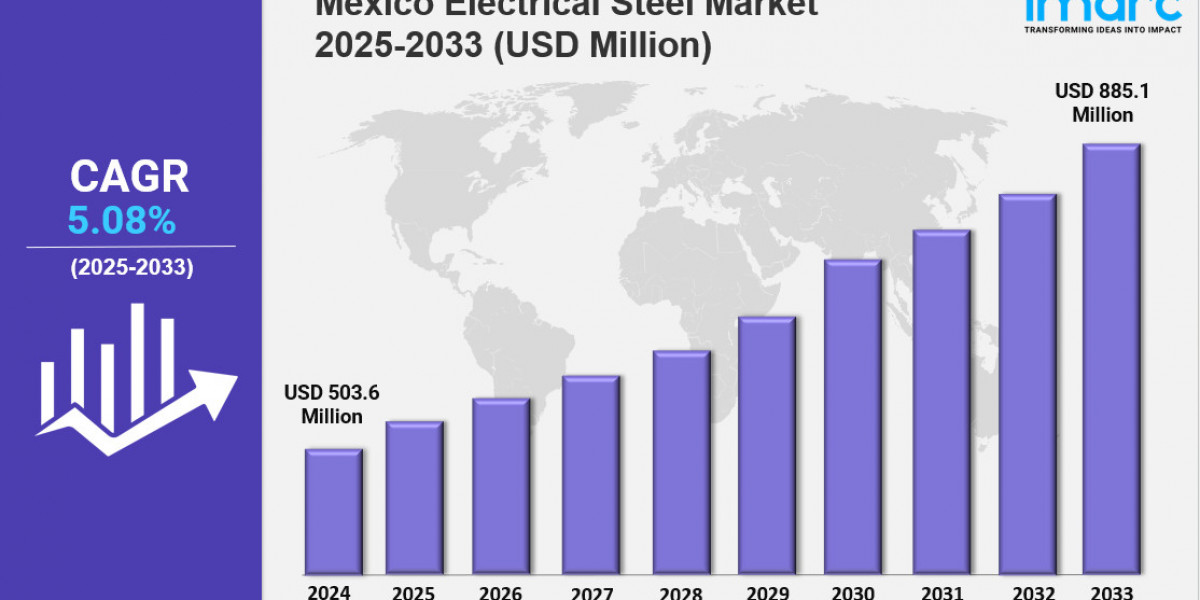

Market Overview 2025-2033

The Mexico electrical steel market size reached USD 503.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 885.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033. The market is expanding due to rising power infrastructure investments, electric vehicle production growth, and grid modernization efforts. Growth is driven by transformer and motor demand, advanced steel grades, and supportive policies, making the sector more efficient, innovative, and competitive

Key Market Highlights:

✔️ Steady market growth driven by expanding industrial, automotive, and energy sector demand

✔️ Rising adoption of high-permeability and low-loss electrical steels for transformers and electric motors

✔️ Increasing investments in domestic steel production capabilities and advanced alloy innovations

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-electrical-steel-market/requestsample

Mexico Electrical Steel Market Trends and Drivers:

Mexico’s accelerated clean energy agenda is reshaping the Mexico Electrical Steel Market, driving record-breaking demand for grain-oriented electrical steel (GOES) critical to wind and solar infrastructure. In 2024, the Comisión Federal de Electricidad (CFE) launched a $3.1 billion grid modernization plan requiring 48,000 tons of ultra-low-loss steel for high-efficiency transformers. Ternium México captured a dominant Mexico Electrical Steel Market Share—67%—by leveraging its advanced HiB (High Permeability) production line at the Monterrey mill.

Meanwhile, the electric vehicle (EV) boom intensified pressure on non-oriented electrical steel (NOES) supply: Tesla’s Gigafactory in Nuevo León consumed 19,000 tons of NOES for 500,000 EV motors annually, a major contributor to the expanding Mexico Electrical Steel Market Size. Supply volatility emerged in 2024 as USMCA origin rules disrupted Chinese imports, prompting Villacero to fast-track hydrogen-based reduction technologies, slashing production costs by 32%. Parallel industrial demand surged: Siemens México reported an 89% year-over-year rise in NOES orders for servo motors, powered by the nearshoring-driven automation wave across manufacturing sectors.

Mexico’s relocated production hubs demanded region-specific formulations of electrical steel. The Kia-Samsung HVAC joint venture in Nuevo León, for instance, required 0.18mm humidity-resistant laminations, fulfilled by Posco México’s proprietary zinc-magnesium coatings. In aerospace, the Bajío cluster drove demand for ultra-thin cobalt-alloyed NOES, prompting ArcelorMittal’s $220 million investment in a Silao facility capable of producing 0.10mm high-precision grades. Regulatory changes further shaped the Mexico Electrical Steel Market—NOM-029 standards in 2024 mandated 20% lower core losses in industrial motors.

Gerdau Corsa responded with laser-scribed domain refinement, achieving 1.3W/kg performance thresholds. As the U.S. imposed anti-dumping duties on Mexican NOES, 41% of output was redirected to Colombia and Brazil, further internationalizing Mexico’s market dynamics. Sustainability emerged as a competitive differentiator. The 2024 carbon border tax made scrap-based production economically viable. Deacero's $180 million "Acero Verde" plant in Puebla led this shift, refining electrical steel via electric arc furnace (EAF) using 92% recycled automotive scrap—cutting CO₂ emissions by 74% compared to traditional blast furnaces.

Government subsidies from the Secretariat of Economy (SE) covered 30% of silicon recycling R&D costs, allowing ThyssenKrupp to recover 98% pure silicon from decommissioned solar panels. Closed-loop systems gained traction: GM México sourced 53% of Nemak’s NOES feedstock from end-of-life EV motors. Quality remained a hurdle—CANACERO’s 2024 findings revealed early recycled NOES failed 38% of noise-vibration tests until Tenaris introduced rare-earth microalloying to stabilize performance. Expected to reach $1.8 billion by 2028, the Mexico Electrical Steel Market Size reflects a sector in the midst of transformation—driven by decarbonization, industrial electrification, and material circularity.

Voltage-class specialization emerged as a turning point in 2024: Ternium’s Apodaca plant retooled to produce exclusively 345kV+ transformer steel for Iberdrola’s Maya Wind Complex. Diversification extended beyond autos—robotics applications grew 37% year-over-year, while medical imaging usage surged 29%, reinforcing the sector’s vertical expansion. Geographic clustering intensified with Monterrey commanding 78% of 2024’s new production capacity, serving the U.S. EV corridor, while Ternium’s new Yucatán site targeted offshore wind clients. Market dynamics shifted significantly:

JFE Steel’s exit enabled Villacero to capture 52% of the GOES Mexico Electrical Steel Market Share, accelerated by a strategic licensing deal with Mitsui. Emerging catalysts include commercialization of amorphous steel—POSCO’s 2024 pilot supplied 40% of CFE’s distribution transformers—and AI-enhanced alloy design. IBM Watson’s collaboration with Mexican steelmakers reduced alloy R&D timelines from 18 months to just 11 weeks. With NOES prices rising 19% amid global silicon shortages, domestic silicon smelting will be crucial to unlocking the next phase of growth in the Mexico Electrical Steel Market.

Mexico Electrical Steel Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

Grain Oriented Electrical Steel

Non-Grain Oriented Electrical Steel

Breakup by Application:

Transformers

Motors

Generators

Others

Breakup by End Use Industry:

Energy and Power

Automobiles

Household Appliances

Building and Construction

Others

Breakup by Region:

Northern Mexico

Central Mexico

Southern Mexico

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145