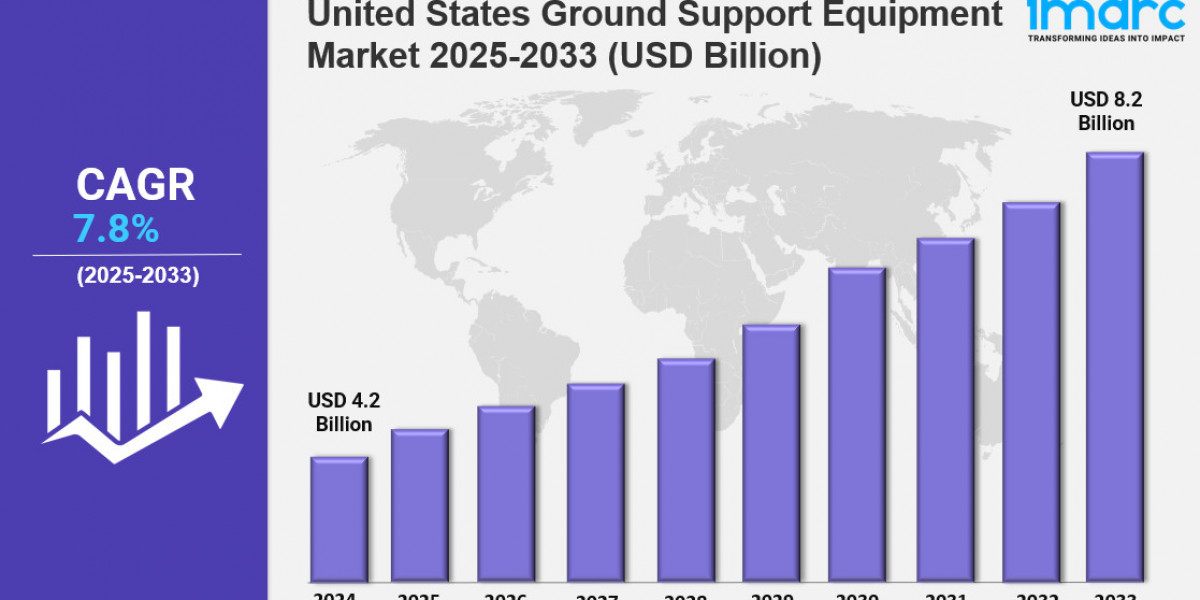

Market Overview 2025-2033

United States ground support equipment market size reached USD 4.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.2 Billion by 2033, exhibiting a growth rate (CAGR) of 7.8% during 2025-2033. market is growing due to increasing air travel, infrastructure modernization, and demand for eco‑friendly solutions. Growth is driven by electrification, IoT integration, and automated systems, making the sector more efficient, digital, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by increasing air traffic and expansion of airport infrastructure

✔️ Rising demand for electric and hybrid ground support equipment to meet sustainability goals

✔️ Expanding automation and integration of telematics for real-time equipment monitoring and maintenance

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-ground-support-equipment-market/requestsample

United States Ground Support Equipment Market Trends and Drivers:

The United States Ground Support Equipment Market is undergoing a transformative shift, fueled by aggressive electrification and digitization across major aviation hubs. Airports such as LAX and JFK have committed to zero-emission ground operations by 2035, prompting a large-scale replacement of diesel-powered units with electric alternatives. In 2024 alone, the FAA’s Voluntary Airport Low Emission (VALE) Program allocated $186 million for GSE charging infrastructure upgrades, accelerating this transition. Cost-efficiency is a major driver—electric GSE units offer operational savings of nearly 65% per hour compared to traditional fossil fuel models.

As a result, the United States Ground Support Equipment Market Size expanded notably, with a 78% year-over-year surge in lithium-ion-powered baggage tugs, belt loaders, and GPUs. Manufacturers like JBT and TLD introduced quick-swap battery systems to reduce downtime, although the availability of rare-earth minerals remains a supply chain constraint. Federal incentives under the Inflation Reduction Act are helping offset early adoption costs, solidifying market momentum. Technological innovation is also reshaping the United States Ground Support Equipment Market Share through automation and AI integration.

United Airlines' deployment of 120 autonomous electric tow tractors at Chicago O’Hare now handles approximately 85% of pushback operations without human intervention. These smart units utilize IoT sensors, generating over 2 terabytes of data daily, which feeds machine learning models that predict maintenance needs with 92% accuracy. The 2024 adoption of 5G-enabled GSE fleets enabled real-time communication between autonomous baggage carts and back-end systems, cutting tarmac congestion by 30–40%. While cybersecurity risks are a concern, the industry has responded with a 45% uptick in investment in blockchain-based firmware verification tools to strengthen digital defenses.

Meanwhile, a booming aftermarket segment is redefining asset life cycles. As capital expenditure tightens, operators are turning to refurbished electric tugs and GPUs, which are typically 40–50% less expensive than new units. The secondary GSE market grew by 22% in 2024, capturing roughly 35% of the sector’s maintenance revenue. This includes advanced battery diagnostics using NASA-grade models and retrofit electrification kits for diesel legacy units. Updated FAA depreciation rules now allow 10-year write-offs for retrofitted electric GSE, compared to seven years for new equipment—further incentivizing aftermarket investment. Interestingly, this segment is supported by the adoption of newer technologies, as airlines reallocate older units to regional airports, boosting the United States Ground Support Equipment Market Share in secondary and tertiary locations.

The sector is also embracing new procurement models and modular design standards. Leading carriers like Delta are now adopting “GSE-as-a-Service” models, covering equipment, maintenance, and charging infrastructure under pay-per-use contracts—reducing upfront investment by up to 70%. Textron’s modular battery architecture, compatible with 80% of its product lineup, exemplifies the trend toward standardization and flexibility. Regionally, Sun Belt states like Arizona and Florida are outpacing coastal cities in equipment renewal, driven by favorable weather conditions and state-level tax incentives. As a result, Phoenix and Orlando have shown GSE modernization rates nearly 50% higher than the national average.

Despite 2024’s ongoing supply chain volatility, the United States Ground Support Equipment Market has demonstrated resilience and adaptability. Nearshoring strategies have cut lead times for critical components from 18 to 9 weeks, while spot-market pricing for battery swaps is emerging to handle peak operational loads. The market is clearly moving from traditional asset ownership to intelligent, usage-optimized systems. Tools like digital twins and AI-powered operational simulators are becoming core to strategic planning, reflecting a market entering a new era of efficiency, sustainability, and technological integration.

United States Ground Support Equipment Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

Powered Ground Support Equipment

Non-Powered Ground Support Equipment

Breakup by Power Source:

Electric

Non-Electric

Hybrid

Breakup by Application:

Aircraft Handling

Passenger Handling

Cargo Handling

Breakup by Region:

Northeast

Midwest

South

West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145