Market Overview 2025-2033

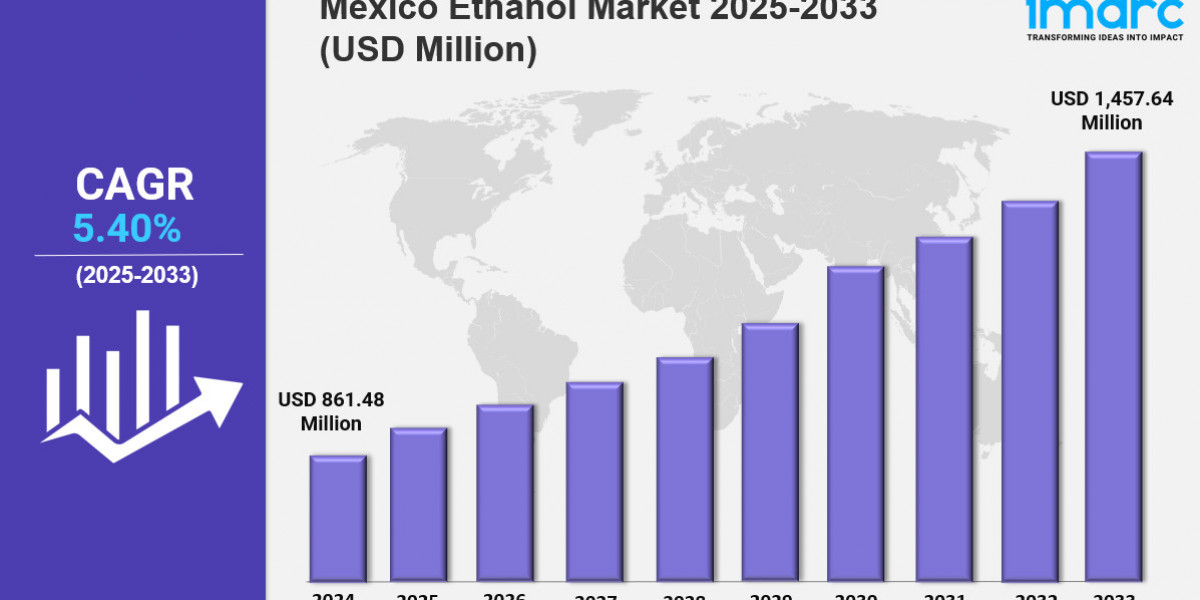

The Mexico ethanol market size reached USD 861.48 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,457.64 Million by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The market is expanding as cleaner fuel demand grows and transport-sector players explore low-emission alternatives. Growth is driven by regional ethanol blending initiatives, improved agricultural supply chains, and supportive pilot programs. With evolving regulations, the industry is becoming more sustainable, efficient, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising demand for clean and renewable fuel alternatives

✔️ Expanding government initiatives to blend ethanol in gasoline to reduce carbon emissions

✔️ Growing investments in domestic ethanol production and sugarcane-based biofuel infrastructure

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-ethanol-market/requestsample

Mexico Ethanol Market Trends and Drivers:

The Mexico ethanol market is going through a period of strong momentum as the country pushes for lower carbon emissions and greater energy self-sufficiency. A big step in that direction came with the federal plan to require E10 ethanol blending nationwide by 2027, following the Supreme Court’s backing of the Ley de Promoción de Bioenergéticos in 2024. This shift has led to major upgrades across the energy sector—PEMEX alone is investing $1.2 billion to retrofit its Minatitlán and Tula refineries. These changes have helped boost ethanol consumption by 38% in just one year, reflecting real progress in Mexico ethanol market growth and attracting international players like Brazil’s Raízen, which recently opened a $400 million sugarcane-based ethanol plant in Veracruz.

At the same time, the market faces supply chain challenges. Much of the ethanol feedstock—about 65% in 2024—still comes from imported U.S. corn. When droughts hit, prices spiked, exposing the risks of overdependence on imports. In response, producers are looking for ways to become more resilient. This includes pursuing international sustainability certifications and adopting new technologies like carbon-capture distillation. There’s also a growing interest in local alternatives: agave and sorghum are becoming attractive options. GreenFuel México, for instance, has seen success with high-yield agave crops, producing up to 2,800 liters per hectare.

Another important development in the Mexico ethanol market trends is the shift toward circular production. BioFields, working with Heineken México, is now turning brewery waste into 50 million liters of ethanol per year. Smaller-scale, decentralized distilleries are also popping up in regions like Jalisco and Oaxaca, using local agricultural waste instead of shipping everything to large refineries. Still, rising fertilizer costs—up 18% in 2024—have hit small farmers hard. Around 30% of them have stepped back from ethanol supply contracts, affecting overall Mexico ethanol market share.

On the international front, Mexico is gaining ground as an ethanol exporter. With rising trade tensions between the U.S. and China, demand has shifted, and Mexico is stepping in with lower freight costs and more flexible supply agreements. Ethanol exports jumped 52% in 2024, with long-term deals signed with Japanese companies like Mitsui. That growth has encouraged more infrastructure investment, such as APM Terminals’ $300 million expansion at the Lázaro Cárdenas port to handle more biofuel shipments. With U.S. tariffs on the rise again, producers are now looking at the EU market, which aligns with Europe’s climate goals under the "Fit for 55" initiative.

Even with these gains, logistical issues persist. Traffic delays at the Panama Canal affected nearly a quarter of Mexico’s ethanol exports in Q3 2024. Competition is also heating up, particularly from Colombian producers. At home, uncertainty around biofuel subsidies under President Sheinbaum’s administration has added another layer of complexity.

Second-generation ethanol is starting to carve out a bigger role in the Mexico ethanol market. Now making up 25% of total market share, 2G ethanol uses agricultural waste instead of food crops. Companies like GranBio are leading this shift, using enzymatic processes to turn residues into biofuel. Industrial buyers are also getting involved—Tesla’s gigafactory in Nuevo León sourced 40% of its ethanol locally in 2024, boosting new supply partnerships across northern Mexico.

Environmental concerns are also shaping how ethanol is produced. In water-scarce states like Sonora, some plants were forced to run at just 45% capacity. To adapt, many are adopting dry-cooling systems that reduce water use. The industry is also seeing major consolidation. FEMSA’s recent $700 million acquisition of Proalcool México signals a push toward controlling the full value chain—from growing feedstock to distributing fuel at the pump.

Looking ahead, the future of the Mexico ethanol market will depend on its ability to meet rising export demand while also addressing domestic energy needs. With over 22 million people in Mexico still lacking access to clean cooking fuels, ethanol has the potential to improve energy access and support rural development. As infrastructure, policy, and technology continue to evolve, the country is well-positioned to build a more balanced and resilient ethanol economy.

Mexico Ethanol Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

Bio Ethanol

Synthetic Ethanol

Breakup by Raw Material:

Sugar and Molasses

Cassava

Rice

Algal Biomass

Ethylene

Lignocellulosic Biomass

Breakup by Purity:

Denatured

Undenatured

Breakup by Application:

Fuel and Fuel Additives

Beverages

Industrial Solvents

Personal Care

Disinfectants

Others

Breakup by Region:

Northern Mexico

Central Mexico

Southern Mexico

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145