The mobile gaming market has become the largest segment of the global games industry, commanding nearly 50% of total gaming revenue. Despite a dip in downloads, in‑app revenue is rebounding as developers pivot to deeper engagement strategies. As we enter 2025, the market landscape is ripe with evolving consumer behavior, smart monetization, cloud tech, and a booming M&A scene.

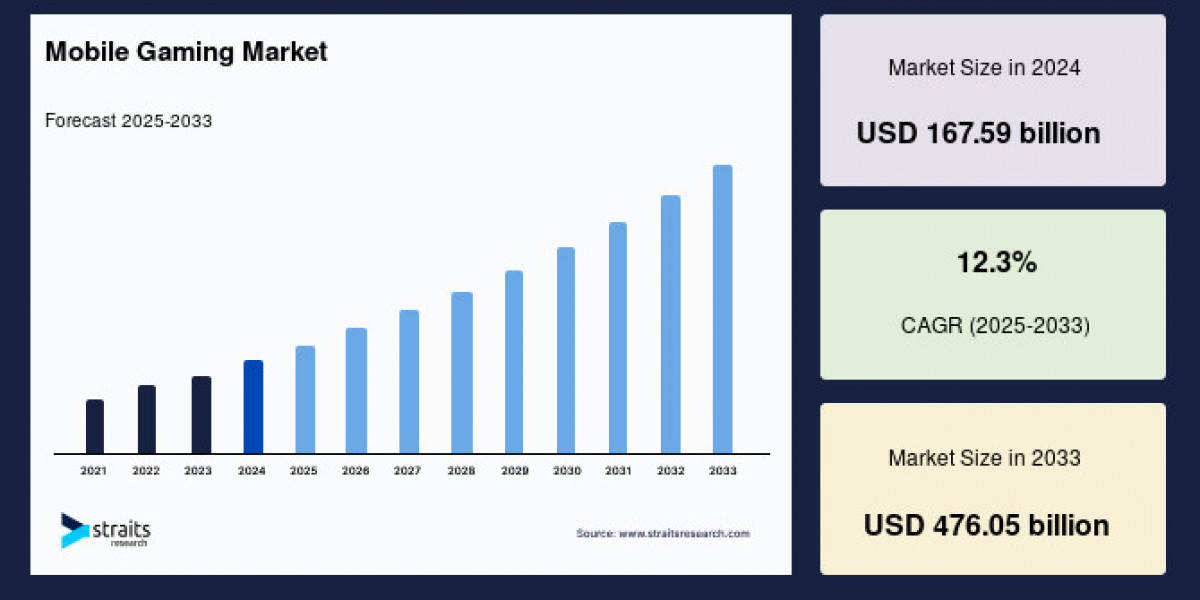

The global mobile gaming market size was valued at USD 167.59 billion in 2024 and is projected to grow from USD 188.2 billion in 2025 to reach USD 476.05 billion by 2033, growing at a CAGR of 12.3% during the forecast period (2025-2033).

Latest Trends

Revenue Rebound

Resilience in spending: After two years of decline, consumer spending across mobile games fell just 2% in 2023 (~$107 bn) and appears to be on track for growth in 2024–25. In‑app purchases (IAP) grew roughly 4%, reaching $81–82 bn in 2024.

Fewer downloads, richer engagement: Downloads dropped by 6–7% (to ~50 bn in 2024), yet active usage rose—session counts +12%, time in app +8%, signaling deeper engagement with core titles.

Mega Hits & Live‑Ops Games

A record 11 titles exceeded $1 bn in annual spending in 2024 (e.g., Last War: Survival, Brawl Stars), expanding the “billion‑dollar club.”

Established genres like MMORPG, strategy (4X), team‑battle RPG, casino/slots remain top spenders, capturing over one-third of global mobile spend.

Shift to Casual and Hybridization

Hyper-casual and casual titles dominate in North America and Europe; mid-core play stronger roles in Asia and Middle East.

Hybrid casual-midcore models are emerging: blending quick play with deeper systems for retention.

Cloud Gaming & eSports on Mobile

Cloud gaming and mobile eSports are growing fast, enabled by 5G.

However, challenges like latency, cheating, content moderation require robust solutions.

Advanced Monetization & Ethical Focus

Game developers deploy ML models to optimize IAP timing and personalization.

“Dark patterns” and probability-based monetization raise ethical concerns—regulators and user advocates are pushing for transparency and protection.

Buy Now: https://straitsresearch.com/buy-now/mobile-gaming-market

Market Challenges

Market Saturation: Overcrowded app stores mean fewer new games making top-1000 lists.

User Acquisition Costs: Marketing costs are escalating, favoring established franchises and acquisitions.

Regulatory Pressures: Privacy, loot-box laws, ad transparency add compliance burdens.

Tech & Infrastructure: Mobile cloud gaming demands low latency and stable 5G connectivity—not yet widely available.

Ethical Scrutiny: Monetization strategies face backlash; balancing revenue with user goodwill is critical to building trust.

Market Opportunities

Live-Ops & User Retention: Emphasizing content updates, events, and community builds stickiness post-download.

Emerging Markets: APAC, especially India, offers massive smartphone adoption and regionalized content hunger. Latin America and parts of Africa are next big frontiers.

Cloud Gaming Niche: As 5G spread accelerates, mobile cloud gaming (e.g., instant streaming titles) creates new avenues.

M&A Synergies: Growth via acquisition of established portfolios offers immediate scale, improved UA efficiency.

Esports & Multiplayer: Mobile esports tournaments and spectator modes are enhancing user engagement and monetization pathways.

Segment Overview

Platform

Android → highest growth path across forecast period—largest user base, affordability.

iOS → premium downloads and ARPU; stronger monetization in Western markets.

Cross-platform & PWAs → smaller but growing, ideal for casual/social gaming.

Device

Smartphones → primary device, 95% of game time.

Tablets → favored for immersive mid-core and strategy titles.

Distribution

App Stores (Google & Apple) → still dominate acquisition and downloads.

Cloud platforms / Macros → game streaming USP remains limited by connectivity.

Web-based PWAs → emerging channel, low friction, cross-device.

Top Players & Recent Developments (DDD)

Scopely & Savvy Games

In March 2025, Scopely (under PIF-backed Savvy) agreed to acquire Niantic’s gaming assets (including Pokémon Go, Monster Hunter Now, Pikmin Bloom) for $3.5 bn. This positions Scopely as a powerhouse in AR/live services and underscores Saudi PIF’s growing gaming influence.

Tripledot Studios & AppLovin Deal

In May 2025, Tripledot bought AppLovin’s mobile games division (including Matchington Mansion, Game of War) for $800 mn, giving Tripledot ~25 mn DAU and ~$2 bn in gross revenues, reinforcing M&A as preferred expansion ^.

Aristocrat Sells Plarium

In late 2024, Aristocrat sold Plarium Global (RAID: Shadow Legends) to Modern Times (Sweden) for ~$820 mn, focusing Aristocrat back on regulated casino operations.

Nazara Technologies (India)

From Aug 2024 to May 2025, Nazara acquired Fusebox Games ($27 mn), 47.7% stake in Moonshine Tech (~₹832 cr), and two mobile titles King of Thieves & CATS for $7.7 mn, plus UK publisher Curve Games—fueling their global footprint.

M&A Market Snapshot

2024 gaming M&A & financing grew ~39% YoY, totaling $27.3 bn across ~967 deals; disclosed M&A was $10.5 bn (198 deals).

Early 2025 saw 42 deals in Q1 ($6.6 bn), including Tencent–Ubisoft and AppLovin–Tripledot, signaling sustained deal momentum.

Private equity and conglomerates remain aggressive, focusing on mobile studios with IP and recurring revenue.

Get Free Database Access: https://access.straitsresearch.com/new-user/mobile-gaming-market

Conclusion

The mobile gaming market is clearly at an inflection point. Although downloads have softened, deepened user engagement, stronger monetization models, and a trend toward consolidation are propelling growth. Runway exists in emerging markets, cloud gaming, and mobile eSports—but ethical practices, infrastructure, and regulation are critical watchpoints. As the sector matures, strategic acquisitions offer a preferred path to scale, incentivizing big players and PE firms to double down. For developers and investors alike, success hinges on live community management, responsible UX, and flexible adaptation to shifting market norms.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

FAQs

1. Why are mobile game downloads falling but revenue rising?

Downloads dropped ~6% in 2024 due to market maturation, but usage metrics like time and session frequency rose—leading to stronger in‑app monetization and higher per-user spend.

2. What genres dominate mobile spending?

Strategy (4X), MMORPG, team-battle RPG, and casino/slots captured over one-third of mobile consumer spending in 2023–24.

3. How is cloud gaming shaping mobile?

5G rollouts are enabling cloud streaming, but latency, data, and infrastructure constraints still restrict broad consumer adoption until networks mature.