IMARC Group, a leading market research company, has recently released a report titled “Venture Capital Investment Market Report by Sector (Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, and Others), Fund Size (Under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, Above $1 B), Funding Type (First-Time Venture Funding, Follow-on Venture Funding), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global venture capital investment market forecast, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How Big Is the Venture Capital Investment Market?

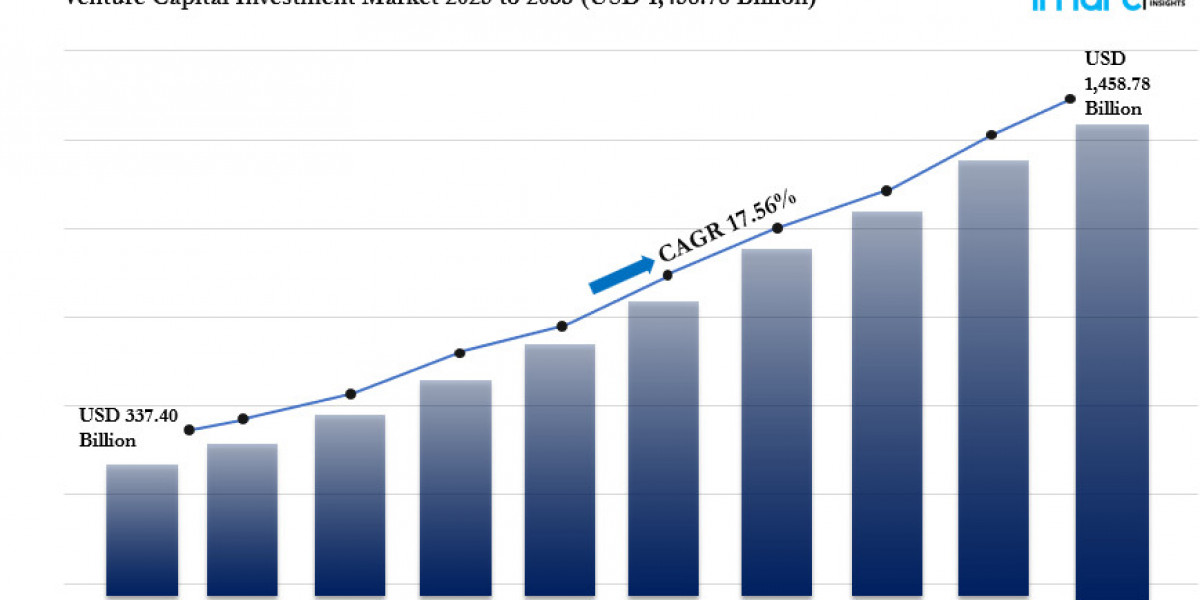

The global venture capital investment market size was valued at USD 337.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,458.78 Billion by 2033, exhibiting a CAGR of 17.56% during 2025-2033. North America currently dominates the market in 2024, with a significant share of around 49.8%. The rapid technological advancements, a surge in startup formations, increasing digital transformation across industries, supportive government initiatives and tax incentives, growing investor interest in high-growth sectors like fintech and biotech, enhanced access to capital through crowdfunding platforms, and expanding corporate venture arms are some of the major factors augmenting venture capital investment market share.

Key Market Highlights:

- Market Growth: The venture capital investment market is witnessing dynamic growth, fueled by innovation across tech, healthcare, and fintech sectors.

- Target Demographics: Primarily supports startups, early-stage companies, and high-growth ventures led by entrepreneurs and disruptors.

- Investment Variety: Includes seed funding, Series A to late-stage investments, and industry-specific funds across diverse verticals.

- Technology Trends: Surge in funding for AI, blockchain, clean tech, and SaaS startups is reshaping the venture landscape.

- Geographic Trends: Strong activity in North America, Asia-Pacific, and emerging markets with expanding startup ecosystems.

- Distribution Channels: Capital deployed through VC firms, corporate venture arms, angel networks, and accelerator programs.

- Exit Strategies: Common exits include IPOs, mergers and acquisitions, and secondary sales, driving investor returns.

- Regulatory Landscape: Influenced by securities regulations, capital gains tax policies, and government incentives for startup funding.

Request to Get the Sample Report:

https://www.imarcgroup.com/venture-capital-investment-market/requestsample

Venture Capital Investment Market Outlook: Trends and Emerging Dynamics

The venture capital investment market is poised for substantial growth, driven by evolving investor priorities and transformative global trends. By 2025, capital allocation is expected to increasingly favor sectors that champion innovation, sustainability, and social responsibility. Investors are broadening their focus beyond high-growth potential to include startups that align with ethical values and tackle global challenges such as climate change, healthcare access, and social equity.

This growing emphasis on purpose-driven investing is giving rise to specialized VC firms dedicated to impact investing—those that seek measurable environmental and social returns alongside financial performance. At the same time, demand remains robust for cutting-edge, technology-driven ventures, particularly in areas such as artificial intelligence (AI), machine learning, and biotechnology.

To stay competitive, venture capitalists are adopting more strategic investment approaches. This includes closer collaboration with accelerators, incubators, and university-led tech-transfer programs to identify promising early-stage innovations. These developments underscore venture capital’s expanding role as a catalyst for innovation and a driver of global economic development.

Market Dynamics Driving Venture Capital Trends and Demand

Strong Focus on Technology and Innovation

The venture capital landscape is undergoing a significant transformation, with a marked shift toward tech-centric startups. By 2025, sectors such as fintech, healthtech, edtech, and enterprise software are expected to dominate VC portfolios, fueled by widespread digital transformation and automation. High-potential startups leveraging technologies like AI, blockchain, and IoT are attracting strong investor interest due to their scalability and disruptive capabilities across legacy industries.

The COVID-19 pandemic further underscored the urgency of digital resilience, particularly in healthcare, finance, and education. As a result, investors are increasingly backing startups with robust technological capabilities and clearly defined value propositions. This tech-forward approach is set to accelerate innovation across verticals, generating value for both entrepreneurs and investors.

Growing Adoption of Sustainable and Impact Investing

Venture capital is increasingly influenced by environmental, social, and governance (ESG) criteria, signaling a major shift toward sustainable and impact-oriented investing. By 2025, ESG considerations will be central to VC decision-making. Firms are aligning their strategies with global sustainability goals, investing in startups focused on renewable energy, water conservation, circular economy solutions, and ethical sourcing practices.

This transformation is being driven by pressure from limited partners (LPs), regulatory expectations, and consumer demand for transparency and accountability. Startups embracing ESG principles are not only seen as socially responsible but also as better positioned for long-term resilience and market relevance. This evolution marks a shift toward more holistic investment models that integrate both purpose and profitability.

Expansion and Globalization of Venture Capital

The globalization of venture capital is becoming a defining feature of the investment landscape. By 2025, VC firms are projected to significantly broaden their international presence, targeting promising startups in fast-growing regions such as Asia, Latin America, and Africa. These emerging markets are characterized by rising digital adoption, youthful populations, and a surge in entrepreneurial ventures.

Remote work and digital collaboration tools have lowered geographic barriers, making cross-border investment more efficient and practical. Investors now have the flexibility to engage with founders globally, evaluate opportunities, and provide guidance without being bound by location. This global diversification reduces risk while unlocking new innovation frontiers, enhancing the inclusivity and resilience of the venture capital ecosystem.

Venture Capital Investment Market Report Segmentation:

Breakup By Sectors:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Software dominates the market, fueled by its rapid growth potential, scalability, and the increasing demand for innovative digital solutions across various industries.

Breakup By Fund Size:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

Investments between $500 million and $1 billion fuel market growth by allowing venture capitalists to engage in larger funding rounds, support the expansion of high-potential startups, and efficiently fulfil their capital needs.

Breakup By Funding Type:

- First-Time Venture Funding

- Follow-on Venture Funding

Follow-on venture funding holds the largest market share, enabling investors to capitalize on the growth of previously funded companies, reinforce their commitment, and foster long-term relationships.

Breakup By Region:

- North America

- Asia Pacific

- Europe

- Others

North America leads the market, fueled by its advanced venture ecosystem, high density of innovative startups, and abundant capital from a diverse investor base.

Top Venture Capital Investment Market Leaders:

The venture capital investment market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Accel

- Andreessen Horowitz

- Benchmark

- Bessemer Venture Partners

- First Round Capital LLC

- Founders Fund LLC

- Ggv Management L.L.C.

- Index Ventures

- Sequoia Capital Operations LLC

- Union Square Ventures LLC

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2336&flag=C

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Market Trends

- Market Drivers and Success Factors

- Impact of COVID-19

- Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800