The e-commerce logistics market has become a critical component of the global retail ecosystem. With the rapid surge in online shopping and digital transactions, logistics providers are under constant pressure to innovate and deliver efficient, reliable, and scalable services. This market encompasses various logistical operations including warehousing, inventory management, last-mile delivery, return handling, and cross-border shipping. As consumer behavior continues to evolve and technology reshapes the landscape, the e-commerce logistics industry is expected to witness sustained growth and transformation in the coming years.

E-commerce logistics refers to the set of services and systems required to move products purchased online from sellers to buyers. This includes order fulfillment, transportation, warehousing, packaging, and delivery. Over the past decade, the growth of internet penetration, smartphone usage, and digital payment solutions has led to a significant increase in online shopping activity, especially in emerging economies.

Key contributors to the e-commerce logistics market growth include rising consumer expectations for faster delivery, increased focus on supply chain optimization, and the growing adoption of automation and AI in logistics operations.

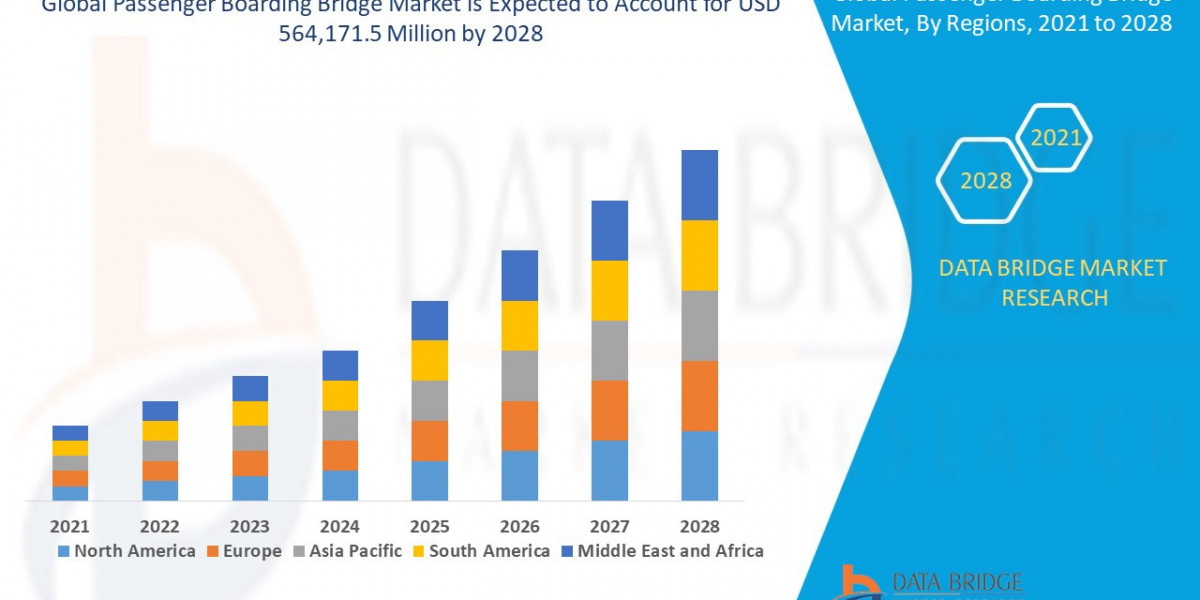

E-Commerce Logistics Market CAGR (growth rate) is expected to be around 14.86% during the forecast period (2024 - 2030).

Key Market Drivers

- Boom in Online Retail

The primary driver of the e-commerce logistics market is the exponential growth in online retail. E-commerce platforms like Amazon, Alibaba, Flipkart, and others have transformed shopping habits, prompting logistics firms to expand their networks and enhance delivery capabilities. With more people opting for the convenience of online shopping, the demand for efficient logistics services continues to rise. - Technological Advancements

Automation, robotics, data analytics, and artificial intelligence are reshaping the logistics sector. From route optimization and real-time tracking to automated warehousing and drone delivery, technology is enhancing operational efficiency and reducing costs. Many logistics providers are investing in smart warehouses and predictive analytics to improve accuracy and meet delivery timelines. - Rise of Same-Day and Next-Day Delivery

Consumer expectations for fast delivery have intensified competition among logistics companies. Same-day and next-day delivery services, once considered premium, are now becoming standard. This shift is pushing e-commerce companies to build micro-fulfillment centers closer to urban hubs and optimize last-mile delivery networks. - Cross-Border E-Commerce

Globalization and international trade liberalization have fueled cross-border e-commerce, leading to a rise in international shipments. Logistics providers now need to manage customs regulations, international warehousing, and longer delivery timelines, requiring more sophisticated infrastructure and coordination. - COVID-19 Impact

The pandemic accelerated digital adoption and changed consumer behavior permanently. With physical stores closing or limiting operations, consumers turned to online platforms, pushing e-commerce logistics providers to scale up operations quickly. This trend has persisted post-pandemic, reinforcing the importance of resilient and scalable logistics systems.

Key players in the E-Commerce Logistics Market include:

DHL International, Gati Limited, Fedex Corp, Aramex International, Kenco Group , Ceva Holdings, United Parcel Services, XPO Logistics, Clipper Logistics

Challenges in the E-Commerce Logistics Market

Despite the positive outlook, the industry faces several challenges:

- Last-Mile Delivery Complexity: Delivering packages in densely populated cities or remote areas can be time-consuming and costly. Urban congestion, traffic regulations, and limited parking access further complicate the process.

- High Return Rates: E-commerce returns are significantly higher than brick-and-mortar retail. Managing reverse logistics efficiently without affecting profitability is a persistent issue.

- Infrastructure Gaps: In developing countries, inadequate transportation infrastructure and fragmented supply chains hinder logistics efficiency.

- Sustainability Concerns: Environmental impact is another concern, especially with increased packaging waste and carbon emissions from frequent deliveries. Logistics firms are under pressure to adopt eco-friendly practices and sustainable delivery models.

For More Information Request for Sample PDF

Emerging Trends

- Use of Drones and Autonomous Vehicles

To overcome last-mile delivery challenges, companies are exploring drones, electric bikes, and autonomous delivery robots. These innovations can reduce costs, improve speed, and reach difficult areas more efficiently. - Blockchain in Supply Chain Management

Blockchain offers transparency and traceability in logistics, helping reduce fraud, improve accountability, and enhance shipment tracking. - Micro-Fulfillment Centers

Retailers are setting up small, automated warehouses within urban areas to enable faster deliveries. These centers use robotics and data analytics for rapid order processing. - Omnichannel Logistics

As businesses adopt omnichannel retail strategies, logistics providers are designing integrated systems to manage orders from multiple sales channels, including physical stores, mobile apps, and websites. - Green Logistics

Environmentally conscious consumers are driving demand for sustainable logistics practices, including electric delivery vehicles, biodegradable packaging, and carbon-neutral shipping options.

Contact Us:

Market Researcnh Future (Part of WantStats Research and Media Pvt. Ltd.)

Contact Number. +91 2269738890

Email: sales@marketresearchfuture.com