Insurtech Market Report - Industry Growth, Trends, and Forecast (2025-2033)

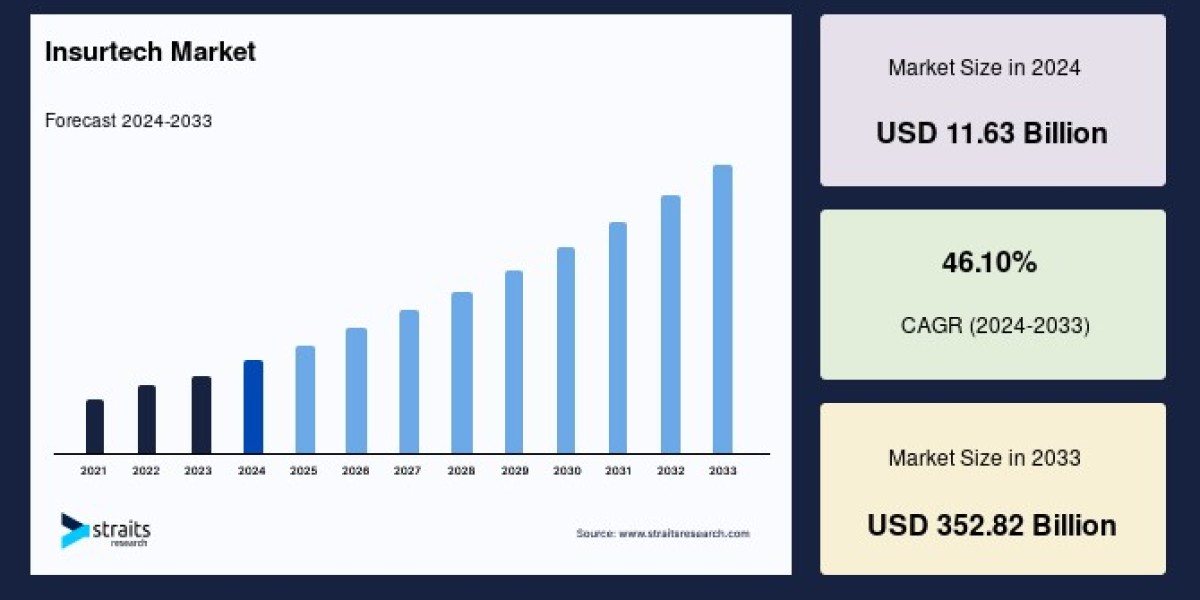

The global Insurtech Market size was valued at USD 11.63 billion in 2024 and is projected to reach from USD 17.00 billion in 2025 to USD 352.82 billion by 2033, at an impressive CAGR of 6.19 % during the forecast period (2025-2033). The rising adoption of advanced digital technologies such as blockchain, artificial intelligence, and IoT is revolutionizing the insurance sector. Download Free Sample

Insurtech, or insurance technology, refers to the use of cutting-edge technology in the insurance industry to enhance efficiency, improve customer experience, and streamline operations. From AI-powered claims processing to IoT-driven risk assessments, Insurtech is disrupting traditional insurance models, making policies more personalized and cost-effective. Buy Now

Market Segmentation The Insurtech Market is segmented into various categories based on type, service, technology, and end-user industries.

By Type (2021-2033)

Auto

Business

Health

Home

Specialty

Travel

Others

By Service (2021-2033)

Consulting

Support and Maintenance

Managed Services

By Technology (2021-2033)

Blockchain

Cloud Computing

IoT

Machine Learning

Robo Advisory

Others

By End-User (2021-2033)

Automotive

BFSI

Government

Healthcare

Manufacturing

Retail

Transportation

Others

Latest Trends Driving the Insurtech Market

Artificial Intelligence and Machine Learning: AI-driven chatbots and claim processing automation are enhancing customer experience.

Blockchain Technology: Secure and transparent transactions are revolutionizing insurance contracts and fraud detection.

IoT and Telematics: Smart devices and connected vehicles are helping insurers assess risk and adjust policies accordingly.

Embedded Insurance: Businesses are integrating insurance within their products and services for added convenience.

Robo-Advisory Solutions: AI-powered advisors are streamlining investment-based insurance solutions. Download Free Sample

Growth Factors and Opportunities

The increasing demand for cost-effective insurance policies is driving the market.

Technological advancements, such as AI, cloud computing, and big data analytics, are propelling industry expansion.

Regulatory support for digital insurance models is fueling innovation.

Startups and established players are collaborating to improve offerings and gain a competitive edge. Buy Now

Key Players in the Insurtech Market

Damco Group

DXC Technology

Insurance Technology Services

Majesco

Oscar Insurance

Quantemplate

Shift Technology

Trov Inc.

Wipro Limited

ZhongAn Insurance

Acko

Coya Visit Now

Conclusion

The Insurtech Market is experiencing a dynamic shift with digital transformation reshaping the insurance landscape. With increasing investment and innovative solutions, the market is set to grow exponentially in the coming years. As digitalization continues to expand, key players and new entrants are expected to drive further advancements, making insurance more accessible and efficient for consumers. Download Free Sample

Frequently Asked Questions (FAQs)

What is Insurtech?

Insurtech refers to the integration of technology and innovation in the insurance industry to enhance operational efficiency, improve customer experiences, and reduce costs.

What are the key technologies driving the Insurtech market?

Key technologies include Artificial Intelligence (AI), Blockchain, Big Data Analytics, the Internet of Things (IoT), and Cloud Computing.

How is AI utilized in Insurtech?

AI is used for underwriting, claims processing, and customer support, leading to enhanced efficiency and reduced operational costs.

What is on-demand insurance?

On-demand insurance allows customers to purchase coverage tailored to