The Global Cryptocurrency Market: Trends, Size, Share, and Regional Insights

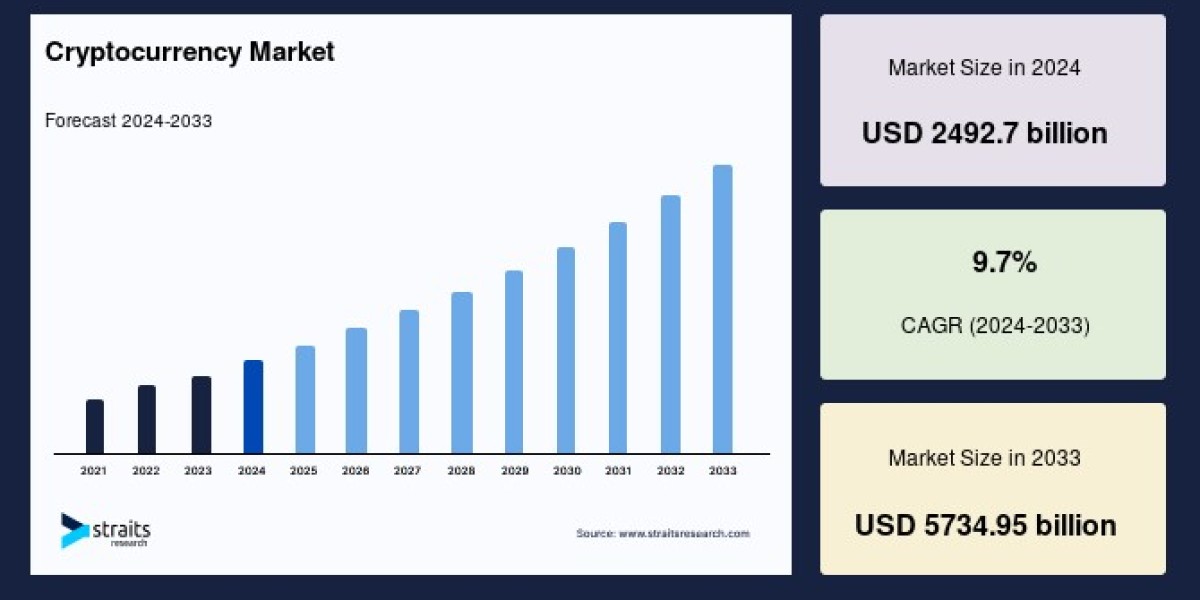

The global cryptocurrency market has seen substantial growth, with its market size valued at USD 2,492.7 billion in 2024. The market is projected to reach an expected value of USD 5,734.95 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.7% during the forecast period from 2025 to 2033.

For more insights and in-depth analysis, Download Free Sample of the report or Buy Now.

Industry Key Trends

Increased Institutional Adoption: Major financial institutions and corporations are increasingly adopting cryptocurrencies, leading to enhanced credibility and mainstream acceptance.

Regulatory Developments: Governments worldwide are implementing regulations to manage the cryptocurrency industry, impacting market growth and investor confidence.

NFT Expansion: Non-fungible tokens (NFTs) continue to revolutionize industries such as art, gaming, and entertainment.

Blockchain Innovations: Advancements in blockchain technology, including Layer 2 solutions and smart contracts, are driving the market forward.

Integration with Traditional Finance: The rise of Central Bank Digital Currencies (CBDCs) and crypto-backed financial products are bridging the gap between traditional and digital finance.

Rise in DeFi and Web3: Decentralized Finance (DeFi) and Web3 applications are creating new investment opportunities and altering the financial ecosystem.

Sustainability Concerns: As environmental concerns rise, energy-efficient blockchain technologies such as proof-of-stake (PoS) are gaining traction.

Cryptocurrency Market Size and Share

In 2024, the cryptocurrency market was valued at USD 2,492.7 billion.

The market is expected to reach USD 5,734.95 billion by 2033.

The industry is set to grow at a CAGR of 9.7% from 2025 to 2033.

The demand for NFTs and decentralized applications is fueling market expansion.

Cryptocurrency Market Statistics

The NFT market is projected to contribute significantly to cryptocurrency adoption.

The gaming and metaverse sectors are integrating blockchain-based assets at a rapid pace.

Institutional investments have increased by over 50% in the last two years.

Bitcoin and Ethereum continue to dominate market capitalization.

Regional Trends

North America

The U.S. and Canada are leading cryptocurrency adoption, with major financial institutions integrating blockchain solutions.

Regulatory frameworks, such as those established by the U.S. Securities and Exchange Commission (SEC), are shaping the industry.

The NFT and gaming markets are expanding rapidly, with major platforms based in Silicon Valley.

Asia-Pacific (APAC)

Countries like China, Japan, South Korea, and India are driving cryptocurrency innovation.

China's ban on cryptocurrency mining has shifted mining activities to other APAC nations such as Kazakhstan and Malaysia.

Japan and South Korea have strong regulatory frameworks supporting crypto trading and NFT adoption.

India is witnessing a surge in crypto adoption despite regulatory uncertainties.

Europe

The European Union (EU) is setting new regulations with the Markets in Crypto-Assets (MiCA) framework to standardize cryptocurrency regulations.

The UK is positioning itself as a global hub for crypto innovation.

Countries like Germany, France, and Switzerland are adopting blockchain-based financial services.

NFTs and decentralized finance (DeFi) are gaining traction across European tech sectors.

LAMEA (Latin America, Middle East, and Africa)

Latin America: Countries like Brazil and Argentina are seeing increased cryptocurrency adoption due to economic instability and inflation.

Middle East: The United Arab Emirates (UAE) is becoming a hub for crypto and blockchain startups.

Africa: Nations such as Nigeria and South Africa are leveraging cryptocurrencies to address banking challenges and promote financial inclusion.

Cryptocurrency Market Segmentations

By Type (2021-2033)

Bitcoin

Ethereum

Altcoins

Stablecoins

Tokens

By Application (2021-2033)

Investment

Payments

DeFi (Decentralized Finance)

Smart Contracts

Gaming and NFTs

By Deployment Mode (2021-2033)

Centralized Exchanges

Decentralized Exchanges (DEX)

Wallets

By End-User (2021-2033)

Retail Investors

Institutional Investors

Banks and Financial Institutions

Governments

Businesses

Top Players in the Cryptocurrency Market

Binance

Kraken

Huobi

OKX

KuCoin

Gate.io

Bybit

The cryptocurrency market is on a trajectory of rapid expansion, with increasing adoption, technological advancements, and investment inflows driving its growth. As industries continue to integrate blockchain and crypto-based solutions, the market is expected to witness substantial transformation.