Future of Executive Summary Europe Trade Surveillance Market: Size and Share Dynamics

CAGR Value

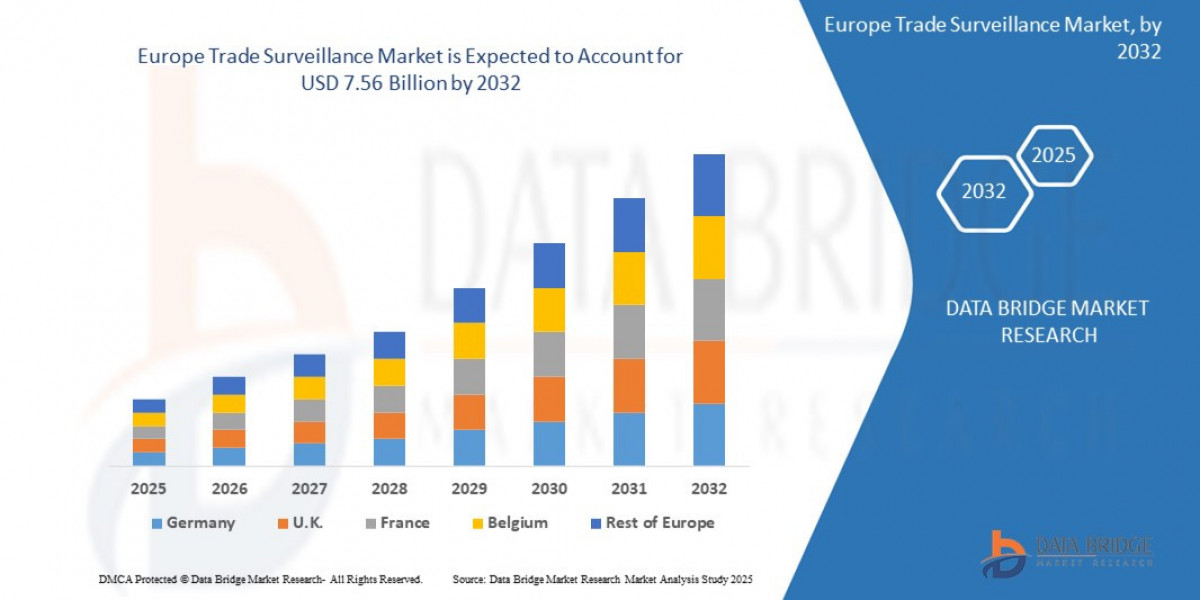

The Europe Trade Surveillance market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 7.56 billion by 2032, at a CAGR of 20.50% during the forecast period

Europe Trade Surveillance Market research report is a sure solution to get market insights with which business can visualize market place clearly and thereby take important decisions for growth of the business. By getting an inspiration from the marketing strategies of rivals, businesses can set up inventive ideas and striking sales targets which in turn make them achieve competitive advantage over its competitors. Europe Trade Surveillance Market report inspects the market with respect to general market conditions, market improvement, market scenarios, development, cost and profit of the specified market regions, position and comparative pricing between major players.

An influential Europe Trade Surveillance Market report conducts study of market drivers, market restraints, opportunities and challenges underneath market overview which provides valuable insights to businesses for taking right moves. This market report is a source of information about Europe Trade Surveillance Market industry which puts forth current and upcoming technical and financial details of the industry to 2029. The report is a window to the Europe Trade Surveillance Market industry which defines properly what market definition, classifications, applications, engagements and market trends are. Moreover, market restraints, brand positioning, and customer behavior, is also studied with which achieving a success in the competitive marketplace is simplified.

Tap into future trends and opportunities shaping the Europe Trade Surveillance Market. Download the complete report:

https://www.databridgemarketresearch.com/reports/europe-trade-surveillance-market

Europe Trade Surveillance Market Environment

**Segments**

- **Component**: The Europe trade surveillance market can be segmented based on components into solutions and services. The solutions segment is anticipated to witness significant growth as there is a growing emphasis on implementing advanced technologies for trade surveillance to mitigate risks and ensure compliance with regulatory standards.

- **Deployment Mode**: The market can be classified by deployment mode into cloud and on-premises. Cloud-based trade surveillance solutions are gaining traction due to benefits like scalability, agility, and cost-effectiveness. On-premises deployment is also prevalent among organizations that prioritize data security and control.

- **Organization Size**: Based on organization size, the market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting trade surveillance solutions to manage their trading activities efficiently and comply with regulatory guidelines. Large enterprises are investing in advanced surveillance technologies to handle extensive trading operations.

- **End-User**: The end-user segment includes banks, financial institutions, brokerage firms, and others. Banks and financial institutions dominate the market demand for trade surveillance solutions to detect market abuse, insider trading, and other fraudulent activities. Brokerage firms are also integrating surveillance tools to monitor trading activities and ensure regulatory compliance.

- **Region**: Geographically, the Europe trade surveillance market is segmented into the United Kingdom, Germany, France, Italy, Spain, and the rest of Europe. Regulatory authorities in these countries are implementing stringent regulations to combat financial crimes, driving the demand for advanced surveillance tools in the region.

**Market Players**

- **NICE Actimize**: NICE Actimize offers comprehensive trade surveillance solutions that leverage artificial intelligence and machine learning to detect suspicious trading patterns and ensure compliance with regulations.

- **IPC Systems**: IPC Systems provides cutting-edge trade surveillance tools for real-time monitoring of trading activities, communication surveillance, and regulatory reporting.

- **FIS**: FIS offers a wide range of trade surveillance services that help financial institutions in identifying potential market abuse and ensuring regulatory compliance.

- **Thomson Reuters**: Thomson Reuters delivers advanced trade surveillance solutions that enable organizations to analyze vast amounts of trading data and detect anomalies efficiently.

The Europe trade surveillance market is witnessing significant growth due to the increasing focus on regulatory compliance and the rising instances of market abuse. The adoption of advanced technologies like artificial intelligence and machine learning is enhancing the capabilities of trade surveillance solutions to detect fraudulent activities and ensure market integrity. The prominent market players are continuously innovating their offerings to cater to the evolving needs of financial institutions and maintain a competitive edge in the market.

The Europe trade surveillance market is undergoing dynamic transformations driven by regulatory initiatives and technological advancements. As financial regulators in countries like the United Kingdom, Germany, and France tighten the reins on market activities to prevent financial crimes and ensure market integrity, the demand for sophisticated trade surveillance solutions is on the rise. Market players are responding by offering innovative solutions that leverage artificial intelligence, machine learning, and real-time monitoring capabilities to detect unusual trading patterns, insider trading, and other fraudulent activities effectively.

One key trend shaping the market is the shift towards cloud-based deployment models. Cloud solutions are gaining momentum among organizations due to their scalability, flexibility, and cost-effectiveness benefits. In a fast-paced trading environment, where agility and real-time insights are crucial, cloud-based trade surveillance systems provide the agility and responsiveness needed to adapt to changing market conditions swiftly. On the other hand, on-premises deployment remains a preference for some firms that prioritize data security and control over their trade surveillance activities.

Moreover, the market segmentation based on organization size reveals a pattern of adoption where both small and medium-sized enterprises (SMEs) and large enterprises are investing in trade surveillance solutions. SMEs are increasingly recognizing the importance of regulatory compliance and efficient trade monitoring to safeguard their trading activities from potential risks. Large enterprises, on the other hand, are deploying advanced surveillance technologies to manage extensive trading operations efficiently and maintain compliance with regulatory standards.

In terms of end-users, banks, financial institutions, and brokerage firms are the key consumers of trade surveillance solutions. Banks and financial institutions are at the forefront of adopting surveillance tools to combat market abuse, insider trading, and other fraudulent activities. Brokerage firms are also ramping up their surveillance capabilities to monitor trading activities and ensure adherence to regulatory guidelines effectively.

As market players like NICE Actimize, IPC Systems, FIS, and Thomson Reuters continue to innovate and enhance their offerings, the competitive landscape of the Europe trade surveillance market is expected to intensify. With a focus on developing more robust and intelligent surveillance solutions, these industry leaders are poised to meet the evolving needs of financial institutions and provide cutting-edge technologies to address the complexities of trade surveillance in the region.

Overall, the Europe trade surveillance market presents a compelling growth trajectory driven by regulatory imperatives, technological advancements, and a heightened focus on market integrity. With an increasing emphasis on compliance, risk mitigation, and fraud detection, the demand for advanced trade surveillance solutions is likely to escalate, creating significant opportunities for market players to innovate and expand their market presence in the region.The Europe trade surveillance market is poised for substantial growth as organizations across various industries increasingly prioritize regulatory compliance and risk management activities. With the evolving regulatory landscape and the heightened focus on market integrity, the demand for advanced trade surveillance solutions is experiencing a surge. Market players are responding by enhancing their offerings with innovative technologies such as artificial intelligence (AI) and machine learning to detect suspicious trading patterns and ensure adherence to regulatory standards effectively.

One of the key trends shaping the market is the adoption of cloud-based deployment models, which offer scalability, flexibility, and cost-effectiveness benefits to organizations. Cloud solutions enable real-time monitoring and analysis of trading activities, providing agility and responsiveness required to navigate the fast-paced trading environment swiftly. However, on-premises deployment options remain relevant for businesses seeking greater control and security over their trade surveillance operations.

The segmentation based on organization size highlights a widespread adoption of trade surveillance solutions by both small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly recognizing the importance of efficient trade monitoring to manage risks and ensure compliance with regulatory guidelines. Large enterprises, on the other hand, are leveraging advanced surveillance technologies to handle extensive trading operations and enhance regulatory compliance measures.

In terms of end-users, banks, financial institutions, and brokerage firms are significant consumers of trade surveillance solutions in Europe. These entities rely on surveillance tools to detect and prevent market abuse, insider trading, and fraudulent activities effectively. Brokerage firms are also integrating surveillance tools into their operations to monitor trading activities and ensure compliance with regulatory requirements.

The competitive landscape of the Europe trade surveillance market is intensifying as market players such as NICE Actimize, IPC Systems, FIS, and Thomson Reuters continue to innovate and enhance their offerings. By focusing on developing intelligent surveillance solutions that address the complexities of trade surveillance and meet the evolving needs of financial institutions, these industry leaders are well-positioned to drive market growth and expand their market presence in the region.

Overall, the Europe trade surveillance market is experiencing significant momentum driven by regulatory imperatives, technological advancements, and the growing emphasis on market integrity. As the demand for advanced trade surveillance solutions continues to rise, opportunities abound for market players to innovate, differentiate their offerings, and capitalize on the evolving needs of the market to stay competitive and drive growth in the region.

Evaluate the company’s influence on the market

https://www.databridgemarketresearch.com/reports/europe-trade-surveillance-market/companies

Forecast, Segmentation & Competitive Analysis Questions for Europe Trade Surveillance Market

- How large is the Europe Trade Surveillance Market currently?

- At what CAGR is the Europe Trade Surveillance Market projected to grow?

- What key segments are analyzed in the Europe Trade Surveillance Market report?

- Who are the top companies operating in the Europe Trade Surveillance Market?

- What notable products have been introduced recently in the Europe Trade Surveillance Market?

- What geographical data is included in the Europe Trade Surveillance Market analysis?

- Which region is experiencing the quickest growth in the Europe Trade Surveillance Market?

- Which country is forecasted to lead the Europe Trade Surveillance Market?

- What region currently holds the biggest share of the Europe Trade Surveillance Market?

- Which country is likely to show the highest growth rate in coming years?

Browse More Reports:

Global Rheology Modifiers Market

Global Mitochondrial Neurogastrointestinal Encephalomyopathy (MNGIE) Market

Central America Safety Footwear Market

Europe Rheology Modifiers Market

Global Combat Management System Market

Global Bone Resorption Inhibitors Market

Global Plasticized Polyvinyl Chloride (PVC) Compound Market

Global 5G Enterprise Market

Global Alpha Blockers Market

Global Biosensors Market

Global Refrigerated Vending Machine Market

Global Transseptal Needle Market

Global Seborrheic Keratosis Market

Global Automotive Key Blanks Market

Global High Performance Computing for Automotive Market

Global Food Color Market

Europe Padded Mailers Market

Global Organic Pigments Market

Global Fluid Power Equipment Market

Global Cottonseed Oil Market

Global Urolithiasis Management Devices Market

Global Topoisomerase Inhibitors Market

North America Wine Market

Asia-Pacific Polyurethane Foam Market

Global Anaerobic Digestion Market

Global Herbal Medicinal Products Market

Global Genetically Modified Organism (GMO) Testing Market

Global Circadian Rhythm Lighting Market

Asia-Pacific Cardiac Computed Tomography (CCT) Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com