IMARC Group has recently released a new research study titled “United States Automation Testing Market Report by Component (Testing Solutions, Services), Endpoint Interface (Web, Mobile, Desktop, Embedded Software), Enterprise Size (Small and Medium-Sized Enterprises, Large Enterprises), End User (IT and Telecommunication, BFSI, Healthcare, Retail, Transportation and Logistics, and Others), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Automation Testing Market Overview

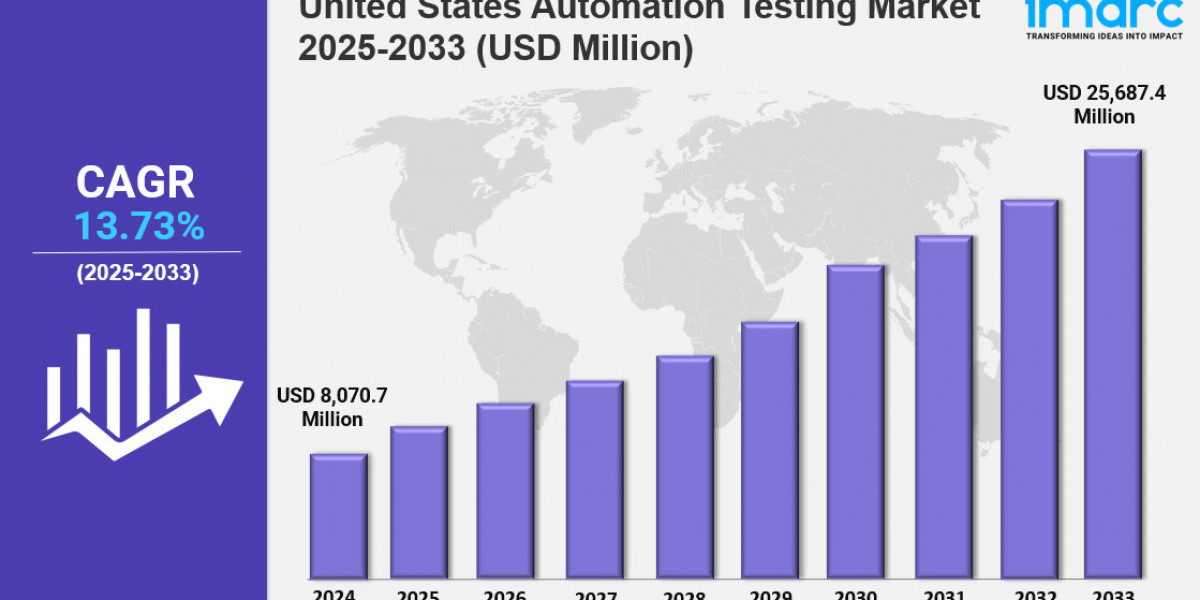

United States automation testing market size reached USD 8,070.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 25,687.4 Million by 2033, exhibiting a growth rate (CAGR) of 13.73% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 8,070.7 Million

Market Forecast in 2033: USD 25,687.4 Million

Market Growth Rate 2025-2033: 13.73%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-automation-testing-market/requestsample

Key Market Highlights:

✔️ Rising demand for faster software delivery is fueling the adoption of automation testing tools

✔️ Growing integration of AI and machine learning for smarter test automation

✔️ Increased focus on reducing manual errors and enhancing test coverage across industries

United States Automation Testing Market Trends

The United States Automation Testing Market is evolving rapidly, shaped by regulatory demands, enterprise modernization, and the push for full-stack automation. As businesses shift toward continuous integration and agile methodologies, testing automation has become a foundational pillar of software development and digital transformation.

The incorporation of AI tools into testing processes is revolutionizing how companies approach quality assurance. Solutions like GitHub Copilot and Testim are reducing test development timelines by up to 60%, enabling organizations to bring products to market faster. By mid-2025, nearly 78% of Fortune 500 companies had adopted AI-generated, context-aware test cases within their CI/CD pipelines.

A notable development came from IBM and SAP in 2024, when they introduced the Watson Test Suite. This innovation reduced false-positive rates in ERP testing from 22% to 3%, underscoring the growing role of neural networks in test optimization. Startups such as Qualitrix are also reshaping the United States Automation Testing Market Growth through no-code, self-healing testing platforms—especially valuable for agile teams managing daily code deployments.

With increased reliance on AI-based testing, the U.S. government has introduced critical oversight. The 2024 Algorithmic Testing Accountability Act, enforced by the FTC, mandates audits for bias in automated test tools. Vendors are now retraining models on diverse datasets to ensure fairness and transparency.

Meanwhile, specialized testing solutions are expanding across industries. The FDA’s 2024 Digital Health Testing Standards created a USD 2.7 billion submarket for validated automation in medical IoT devices. In cybersecurity, new SEC regulations now require automated penetration testing for all publicly traded firms, contributing to a USD 1.1 billion spike in demand for enterprise-grade tools like Burp Suite.

Infrastructure Integration and Shift-Left Adoption

Major cloud platforms are embedding automated testing into infrastructure provisioning. AWS CodeCatalyst and Azure DevTest Labs now offer testing-as-configuration for serverless environments, reducing post-deployment defects by 55%, according to Gartner. This shift-left strategy enables earlier validation of security, compliance, and performance.

As microservices and Kubernetes-based deployments gain traction, service mesh testing tools are rising in popularity. Tools like Istio, integrated with Cypress, have experienced 89% growth among fintech firms seeking PCI-DSS compliance.

United States Automation Testing Market Size Expands with Sectoral Innovation

Sector-Specific Tools and Open-Source Frameworks

The overall United States Automation Testing Market Size continues to expand due to the emergence of industry-specific testing solutions. Platforms such as FinTest.ai are enabling banks to automate Basel III liquidity risk simulations, while MediQA supports HIPAA-compliant testing for electronic health records.

Open-source platforms also play a vital role in broadening access to high-quality testing tools. Selenium 4.0’s support for WebAssembly allows browser-agnostic testing, a crucial capability for decentralized application development.

Despite this growth, mid-market enterprises face toolchain overload. On average, a U.S. enterprise now manages 14.3 testing tools, leading to rising licensing costs of USD 120,000 per year and increasing operational complexity.

Low-code/no-code automation is gaining ground, especially among small and medium-sized businesses. Platforms like Katalon Studio and Tricentis Tosca now account for 43% of the SMB segment, allowing non-engineers to participate in automated quality assurance through drag-and-drop interfaces.

In 2024, Salesforce launched the Einstein Test Cloud, enabling business analysts to create natural language test scripts. This innovation reduced QA team dependencies by 70%, demonstrating the potential of NLP to democratize testing. However, this trend brings new challenges. 31% of tests built by citizen developers lack proper version control, raising concerns around consistency, traceability, and long-term reliability.

United States Automation Testing Market Growth Driven by Hyperautomation and Sustainability

The push toward hyperautomation is transforming test automation from a siloed process into an end-to-end solution. Tools such as UiPath Test Suite now integrate robotic process automation (RPA) with functional testing, enabling comprehensive validation of entire business workflows like quote-to-cash or order fulfillment.

Microsoft’s Azure Test Insights leverages reinforcement learning to optimize test coverage and eliminate redundant cases—cutting testing bloat by nearly 58%. Sustainability efforts are also emerging: Salesforce's EcoTest initiative cut testing-related CO₂ emissions by 19% by running tests during off-peak energy hours.

Future Outlook: Balancing Growth and Governance

As the United States Automation Testing Market heads toward a projected USD 28.6 billion valuation by 2027, businesses face a delicate balancing act. Innovation must be matched with governance, toolchain rationalization, and regulatory compliance.

While quantum computing threatens to disrupt current cryptographic testing practices, today’s challenges—ranging from fragmented ecosystems to skill shortages—require immediate attention. The success of this market will depend on aligning automation innovation with workforce upskilling and sustainable practices.

United States Automation Testing Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Component:

Testing Solutions

Functional Testing

API Testing

Security Testing

Compliance Testing

Usability Testing

Others

Services

Professional Services

Managed Service

Breakup by Endpoint Interface:

Web

Mobile

Desktop

Embedded Software

Breakup by Enterprise Size:

Small and Medium-sized Enterprises

Large Enterprises

Breakup by End User:

IT and Telecommunication

BFSI

Healthcare

Retail

Transportation and Logistics

Others

Breakup by Region:

Northeast

Midwest

South

West

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20365&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302