MARKET OVERVIEW

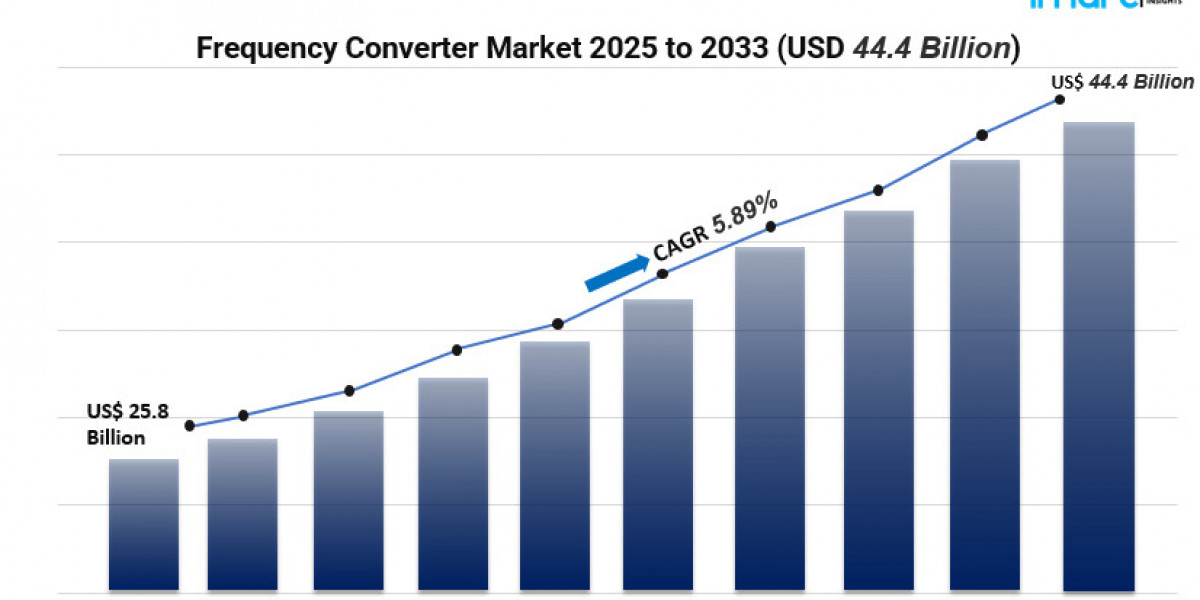

The global frequency converter market reached USD 25.8 billion in 2024 and is projected to grow to USD 44.4 billion by 2033, at a 5.89% CAGR (2025–2033). Rising industrial automation, expanding adoption in traction and offshore renewable projects, and innovations such as advanced output filters that reduce common-mode currents are driving demand for efficient, variable-frequency power conversion across aerospace, energy, manufacturing and transport sectors.

STUDY ASSUMPTION YEARS

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

FREQUENCY CONVERTER MARKET — KEY TAKEAWAYS

- Global market size was USD 25.8 Billion in 2024 and is forecast to reach USD 44.4 Billion by 2033, at a CAGR of 5.89% (2025–2033).

- Asia Pacific currently dominates the market, driven by industrialization and renewable energy projects.

- Static Frequency Converter holds the largest share among types due to efficiency and compactness.

- Aerospace & Defense leads end-use industries, using converters for precision control and monitoring.

- Growing adoption across traction, marine/offshore, power & energy, oil & gas, and process industries broadens application scope.

- Product innovation (e.g., advanced output filters) and rising high-speed rail and offshore wind projects are key growth accelerants.

MARKET GROWTH FACTORS

Technological Advancements and Product Innovation

The rapid pace of technological advancement—especially in areas like semiconductor switching, control algorithms, and output filtering—has really boosted the performance and attractiveness of frequency converters. Today’s static converters come equipped with high-efficiency IGBT/SiC-based power stages and sophisticated output filters that minimize common-mode currents, resulting in outputs that are almost sinusoidal. This not only reduces stress on motors and cuts down on electromagnetic interference (EMI) but also makes the converters more compact, enhances energy efficiency, and prolongs the lifespan of equipment. For manufacturers, these upgrades are becoming increasingly appealing from an economic standpoint. With digital control and diagnostics now becoming the norm, converters are also providing features like predictive maintenance, remote monitoring, and more precise speed and torque control, which helps optimize processes in manufacturing, marine drives, and rail traction. The blend of greater reliability, lower maintenance requirements, and improved power quality is driving retrofit projects and encouraging OEMs to specify these advanced converters—ultimately fostering adoption across various industries that are eager to boost productivity and reduce lifecycle costs.

Regulatory & Standards-Driven Adoption

Regulatory trends and industry standards surrounding energy efficiency, power quality, and grid interconnection are driving a surge in the adoption of frequency converters. In many areas, stricter efficiency requirements for motors and drives are pushing end users to switch to variable-frequency solutions, helping them stay compliant while also cutting down on operational costs. Additionally, grid codes for integrating renewable energy—particularly for offshore wind and distributed generation—demand converters that can ensure grid-friendly operations, manage reactive power, and handle fault-ride-through situations. Safety and electromagnetic compatibility (EMC) standards are also encouraging the use of advanced filter technologies and certified designs, which raises the expectations for older systems. In the aerospace and defense sectors, the need to meet stringent qualification standards is fueling the demand for highly reliable, rugged converters that deliver consistent performance. Together, these regulations and standards are shaping a marketplace where compliant, feature-rich converters are favored in specifications and experience quicker procurement processes.

Expanding End-Use Demand & Regional Infrastructure Growth

The growing trends in industrialization, electrification of transport, and energy transitions are driving up the demand for frequency converters across various applications. In the aerospace and defense industries, these converters are essential for precise axis control and seamless systems integration. Meanwhile, the traction sector, which includes high-speed rail systems, relies on sturdy and efficient converters to manage motors and enhance ride quality. Additionally, the rise of offshore wind and marine projects is boosting the need for converters that can handle variable-speed turbines and subsea equipment. In manufacturing and process industries, variable-speed drives are key to increasing productivity and cutting down on energy use. The rapid development of infrastructure in the Asia Pacific region—spanning rail systems, power networks, and renewable energy—along with modernization efforts in Europe and North America, is creating a strong demand in these areas. This expansion across different sectors is leading to a variety of procurement options: OEMs are integrating converters into their platforms, utilities are deploying grid-grade units, and industrial users are retrofitting systems to save energy.

Request for a sample copy of this report: https://www.imarcgroup.com/frequency-converter-market/requestsample

MARKET SEGMENTATION

Breakup by Type:

- Static Frequency Converter

Compact solid-state converters using semiconductor switching to produce variable frequency and voltage outputs; favored for high efficiency, low maintenance, and precision speed control across industrial and traction applications. - Rotary Frequency Converter

Electromechanical converters that use a rotating machine to change frequency; robust for certain heavy-duty and legacy applications where isolation and specific waveform characteristics are required.

Breakup by End Use Industry:

- Aerospace and Defense

Frequency converters provide precise speed/torque control, system monitoring and power conditioning in aircraft systems, test rigs, defense platforms, and mission-critical instrumentation. - Power and Energy

Converters enable renewable integration, grid support, and efficient motor control in power plants, inverter stations, substations, and distributed energy resources. - Oil and Gas

Used for controlling pumps, compressors and drilling equipment; converters improve operational efficiency and reduce mechanical stress in onshore and offshore installations. - Traction

Critical for rail and mass transit, converters regulate traction motors for acceleration, braking, and energy regeneration in high-speed and urban transit systems. - Marine/Offshore

Marine converter systems support propulsion drives, dynamic positioning and subsea equipment, delivering reliable operation in harsh offshore environments. - Process Industry

Employed in continuous and batch processing to manage pump, fan and compressor speeds, enhancing throughput, quality and energy savings in manufacturing. - Others

Covers diverse niche uses including mining, utilities, and specialized industrial machinery where variable frequency control benefits performance and lifecycle costs.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

REGIONAL INSIGHTS

The Asia Pacific region is at the forefront of the frequency converter market, fueled by significant investments in infrastructure, swift industrial modernization, extensive rail electrification, and a surge in offshore wind capacity. The strong manufacturing presence, government backing for renewable energy, and increasing automation in countries like China, India, and Southeast Asia are driving demand and technological advancements across various sectors.

RECENT DEVELOPMENTS & NEWS

Lately, the market has been buzzing with product enhancements and sector expansions: manufacturers are now incorporating advanced output filters to minimize common-mode currents and deliver cleaner sinusoidal outputs, tackling issues like EMI and motor stress. The rise in high-speed rail projects and offshore wind installations has emerged as a key growth area, with converters being chosen for their precise speed control and compatibility with the grid. Additionally, the aerospace and defense sectors are seeing growth due to the need for reliable frequency control in both testing and operational systems. All in all, innovations in filter technology, semiconductor efficiency, and digital diagnostics are influencing current procurement and retrofit trends highlighted in the report.

KEY PLAYERS

- ABB Asea Brown Boveri Ltd.

- General Electric (GE) Company

- Aplab Limited

- Siemens AG

- Danfoss A/S

- Magnus Power Private Limited

- Georator Corporation

- Advance Electronic Labs., Corp.

- Piller Group (Langley Holdings PLC)

- NR Electric Co. Ltd.

- KGS Electronics, Inc.

- Avionic Instruments LLC

- Power System & Controls, Inc.

- Shenzhen Sinepower Technology Co., Ltd.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1497&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (+1-201971-6302)