Managing unexpected expenses can be challenging, especially for individuals with poor credit history. Payday loans bad credit UK provide an accessible short-term financing option for borrowers who may struggle to obtain traditional loans. By opting for payday loans bad credit uk applicants can secure funds quickly, even with a less-than-perfect credit record.

Understanding Payday Loans Bad Credit UK

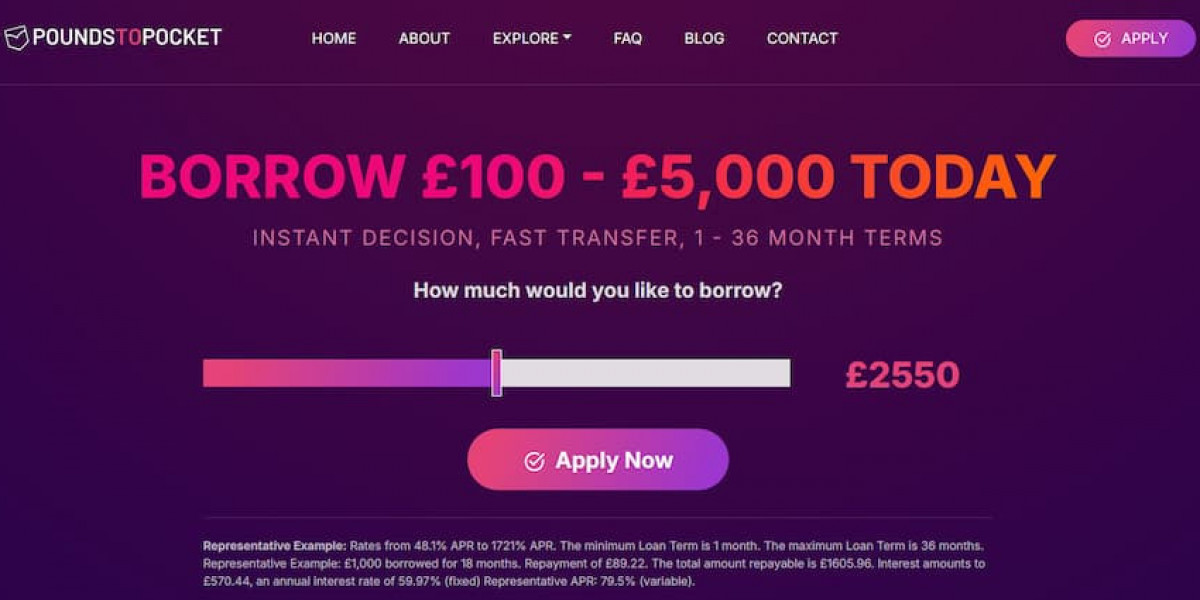

Payday loans bad credit UK are short-term, high-interest loans designed to help individuals meet urgent financial needs. Loan amounts typically range from £100 to £1,500, with repayment due on the borrower’s next payday. The defining feature of payday loans bad credit UK is their accessibility: lenders often prioritize current income over credit history, enabling more people to qualify.

Key Features of Payday Loans Bad Credit UK

Accessible to Low Credit Borrowers: One of the main advantages of payday loans bad credit UK is that individuals with poor credit histories can still access funding.

Rapid Approvals: Applications for payday loans bad credit UK are processed quickly, often resulting in same-day fund transfers.

Transparent Terms: Interest rates, fees, and repayment schedules for payday loans bad credit UK are clearly disclosed upfront, reducing the risk of hidden costs.

Flexible Eligibility Criteria: Lenders offering payday loans bad credit UK often consider proof of income rather than credit score, broadening access.

Why Choose Payday Loans Bad Credit UK?

Borrowers often turn to payday loans bad credit UK when conventional loans are unavailable due to poor credit. These loans provide immediate relief for emergency expenses such as medical bills, car repairs, or unexpected household costs. By using payday loans bad credit UK, individuals can cover urgent financial gaps while maintaining day-to-day stability.

Selecting the Right Payday Loans Bad Credit UK

When choosing payday loans bad credit UK, borrowers should evaluate interest rates, fees, repayment schedules, and FCA compliance. FCA-authorized lenders offering payday loans bad credit UK ensure ethical lending practices. Reviews and testimonials can help identify reliable lenders. It’s crucial to assess your repayment capacity before taking payday loans bad credit UK to avoid financial difficulties.

Advantages of Payday Loans Bad Credit UK

Immediate Access to Cash: Quick approvals allow borrowers to receive funds promptly.

Accessible for Poor Credit: Individuals with low or poor credit scores may still qualify for payday loans bad credit UK.

Transparent Lending: FCA-compliant lenders offering payday loans bad credit UK ensure fair and ethical practices.

Convenient Application: Most payday loans bad credit UK can be applied for online, reducing administrative delays.

Potential Risks

While useful, payday loans bad credit UK often carry higher interest rates compared to traditional loans. Late or missed repayments can result in additional fees and may contribute to a cycle of debt. Borrowers should only use payday loans bad credit UK if confident in their ability to repay on time.

Conclusion

Payday loans bad credit UK provide a fast, regulated, and transparent solution for short-term financial emergencies, particularly for those with poor credit histories. By selecting FCA-compliant lenders, understanding repayment terms, and borrowing responsibly, individuals can utilize payday loans bad credit UK to manage urgent expenses while preserving long-term financial stability.