Introduction

The rapid growth of solar energy as a renewable source has transformed the global energy landscape. With millions of photovoltaic (PV) panels installed worldwide, the issue of managing end-of-life panels has become increasingly urgent. Solar panels typically last 25 to 30 years, and as early installations approach the end of their lifecycle, recycling has emerged as a critical industry.

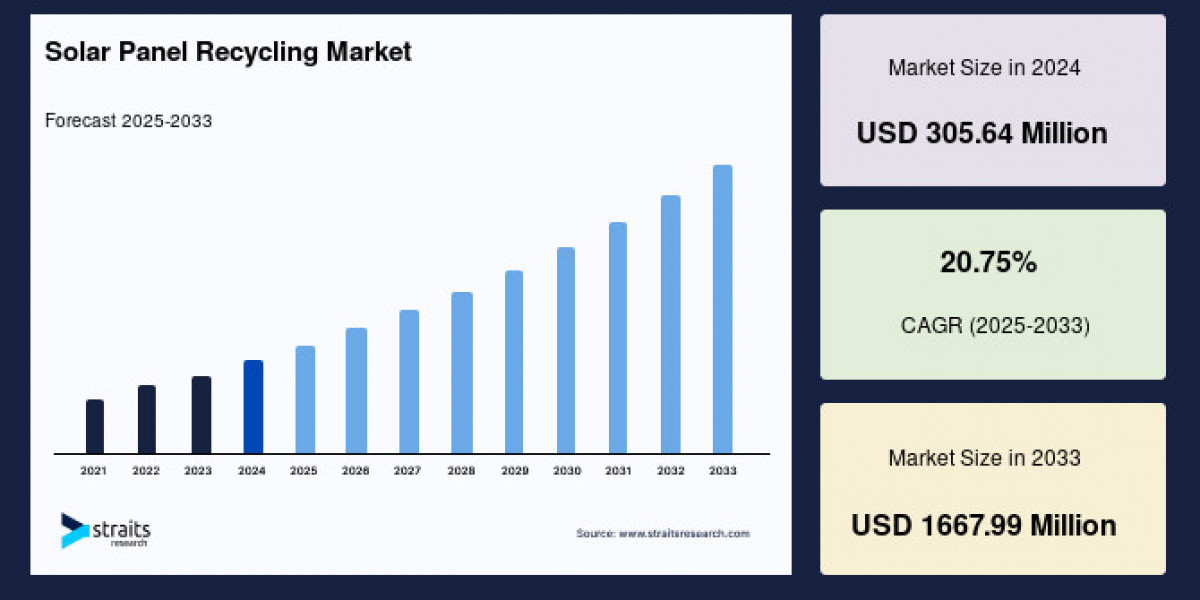

The global solar panel recycling market size was valued at USD 305.64 million in 2024 and is projected to grow from USD 369.06 million in 2025 to reach USD 1667.99 million by 2033, growing at a CAGR of 20.75% during the forecast period (2025–2033).

The global solar panel recycling market was valued at around USD 305 million in 2024 and is expected to reach USD 1.66 billion by 2033, expanding at a CAGR of more than 20% during the forecast period. This remarkable growth reflects the increasing importance of resource recovery, environmental sustainability, and circular economy practices.

Market Dynamics

Key Growth Drivers

Rising Solar Installations

With solar becoming one of the fastest-growing sources of power generation worldwide, the sheer number of panels reaching end-of-life is rising dramatically. This surge creates a steady supply of recyclable material.Regulatory Push

Governments, particularly in Europe and North America, are implementing strict regulations on electronic waste, encouraging solar manufacturers and energy companies to adopt recycling solutions.Resource Scarcity

Critical materials such as silver, silicon, indium, and aluminum are limited in supply. Recycling ensures these valuable resources are recovered and reused, reducing dependence on mining.Technological Advancements

Innovative recycling techniques like laser processing, thermal treatment, and chemical separation are increasing recovery efficiency and improving the purity of reclaimed materials.Sustainability Goals

As nations and corporations commit to net-zero carbon targets, solar panel recycling supports greener supply chains and strengthens circular economy initiatives.

Challenges

High Costs: Recycling costs often exceed landfill disposal, limiting adoption in developing regions.

Infrastructure Gaps: Many countries lack dedicated recycling plants, creating logistical challenges.

Complex Panel Composition: Different panel technologies require specialized recycling processes, raising technical and cost barriers.

Market Segmentation

By Panel Type

Monocrystalline Panels: Dominant segment due to their widespread use and long lifespan.

Polycrystalline Panels: Significant share, though gradually losing ground to more efficient alternatives.

Thin-Film Panels: Fastest-growing segment, requiring advanced recycling due to specialized materials like cadmium telluride.

By Recycling Process

Mechanical Recycling: Largest share; involves shredding and separation, cost-effective for large volumes.

Thermal Processing: Effective in recovering silicon and metals through controlled heating.

Chemical Recycling: Increasingly adopted for high-purity recovery of materials.

Laser-Based Recycling: Emerging technology enabling precision recovery of delicate and valuable materials.

By Material Recovered

Glass: Makes up 60 75% of a panel’s weight, easily recyclable and used in new construction or panels.

Metals: Silver, aluminum, and copper represent the most valuable components, essential for electronics and new panels.

Silicon: A critical material reused in new PV manufacturing.

Others: Plastics, rare earths, and specialty coatings.

By Shelf Life

Early Loss: Panels discarded before their expected lifespan due to defects or damage.

Normal Loss: Panels recycled after 25 30 years of use, which will dominate the market in the long run.

Regional Insights

Europe Market Leader

Europe holds the largest share of the solar panel recycling market. Strong environmental regulations, especially under the Waste Electrical and Electronic Equipment (WEEE) Directive, have created a robust framework for recycling. Countries like Germany, France, and Italy lead with advanced recycling plants and strong policy enforcement.

North America High Growth Potential

The United States and Canada are witnessing rapid growth due to rising solar adoption, favorable government policies, and increasing investment in recycling infrastructure. Awareness of environmental responsibility and corporate sustainability initiatives is also boosting the market.

Asia-Pacific Fastest Growing Region

China, Japan, and India dominate the solar installation landscape, and with aging solar infrastructure, recycling demand is projected to skyrocket. Governments are investing in recycling facilities to handle the surge of decommissioned panels expected in the next decade.

Middle East & Africa

While still emerging, this region is expected to see rising demand for recycling as large-scale solar projects mature. The UAE and Saudi Arabia, with massive renewable energy investments, are likely to drive future growth.

Latin America

Countries like Brazil and Chile, where solar adoption is accelerating, present untapped potential for recycling solutions. Limited infrastructure currently restrains growth, but investment opportunities remain strong.

Competitive Landscape

The market is moderately fragmented, with a mix of global companies and regional players. Key strategies include partnerships, mergers, and technological innovation to increase recovery rates and lower costs.

Key Players

First Solar

Veolia

Reiling GmbH & Co.

Silcontel

SunPower Corporation

Canadian Solar

PV Cycle

We Recycle Solar

Echo Environmental

SOLARCYCLE

Recent Developments

Visy-Style Expansion: Several firms are building mega recycling plants capable of processing millions of panels per year.

Partnership Models: Companies are collaborating with solar manufacturers to implement take-back schemes and closed-loop recycling systems.

Technology Upgrades: Emerging mobile recycling units can process panels on-site, reducing transport costs and improving efficiency.

Future Outlook

The solar panel recycling industry is no longer an optional add-on but a necessity for sustainable energy growth. By 2033, the global market is expected to be worth more than USD 1.6 billion, driven by:

Mass retirement of solar panels installed in the early 2000s.

Increasing regulatory pressure to recycle instead of landfill.

Advancements in high-efficiency recycling technologies.

Rising material scarcity, making recycled materials a cost-effective alternative.

Conclusion

The solar panel recycling market is evolving into a cornerstone of the renewable energy industry. While challenges like cost and infrastructure remain, the sector’s long-term potential is undeniable. Europe currently leads with strong regulations, Asia-Pacific is poised for explosive growth, and North America is steadily strengthening its position.

By transforming end-of-life solar panels into a valuable resource stream, recycling not only reduces waste but also secures the supply of critical materials for the next generation of clean energy solutions.