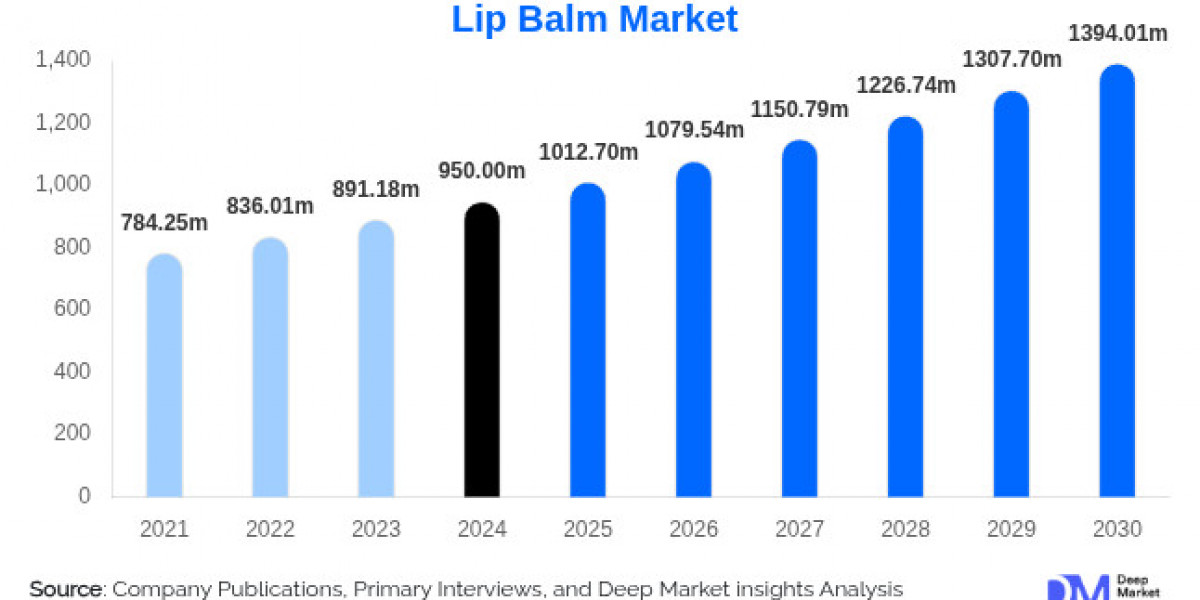

Market Size & Forecast

The lip balm market size was valued at USD 950 million in 2024 and is projected to grow from USD 1,012.70 million in 2025 to USD 1,394.01 million by 2030, growing at a CAGR of 6.6% during the forecast period (2025-2030).

Growth Drivers

This growth is driven primarily by:

Heightened awareness of lip health, particularly concerns about dryness and sensitivity.

Demand for natural ingredients and clean formulations.

Popularity of multi-functional products, offering hydration, tint, and SPF benefits.

Momentum from social media platforms like TikTok and Instagram has popularized tinted, hydrating, and SPF-infused lip balms.

Product & Consumer Trends

Solid Cream Lip Balms remain the most popular format due to their portability, ease of use, and minimal mess.

Tinted and scented lip balms are especially favored by Gen Z and millennials for their cosmetic and skincare appeal.

Women remain the largest consumer group. However, the male and baby care segments are gaining traction.

Demand is rising for dry and sensitive lips care, prompting interest in products featuring clinically backed, soothing ingredients like shea butter, ceramides, calendula, and hyaluronic acid.

Regional Landscape

North America continues to lead the global market, supported by strong retail infrastructure, high consumer awareness, and seasonal demand for lip protection.

Asia-Pacific is the fastest-growing region, propelled by beauty trends (K-beauty, J-beauty), mobile commerce, and rise of e-retail channels in countries such as China, India, South Korea, and Japan.

Europe remains steady, with a high focus on ingredient transparency and sustainable, dermatologist-endorsed formulations. Regulatory frameworks also shape consumer preferences in this region.

Key Trends & Innovations

Premiumization: Increasing appeal of high-end lip balms offering sensory textures, luxurious packaging, and brand prestige.

Examples (2025): Dior's Addict Lip Glow Butter and Chanel’s Rouge Coco Baume both exemplify elevated hydration with cosmetic finesse.

Sustainability & clean beauty:

Brands are adopting eco-friendly packaging (compostable tubes, refills) and clean ingredient labels, such as excluding synthetic dyes and petroleum derivatives.

Male grooming & unisex branding:

The male lip care sector is expanding, with unisex products gaining popularity. By mid-2025, the men's lip balm segment was expected to be worth approx. USD 250 million.

Smart and climate-specific formulations:

Products adapting to individual pH (e.g., Maybelline’s Baby Lips Glow Balm), and those tailored for dry or extreme climates (like Burt’s Bees in cold regions) are becoming more widespread.

Multifunctionality:

Modern consumers favor hybrid lip care products that combine hydration, SPF, tint, and anti-ageing all in one.

Notable releases:

Prada Beauty’s Astral Pink PH-adaptive balm (micro-blushing technology, June 2025).

Glossier’s Balm Dotcom with antioxidant-rich, skincare-forward formula (relaunched May 2024).

Market Challenges & Opportunities

Challenges:

Product oversaturation makes differentiation hard.

Increasing consumer scrutiny of ingredients—especially petroleum-derived bases and synthetic fragrances—puts pressure on brands to prove transparency.

Opportunities:

Growing demand for multi-functional lip care creates room for differentiation.

Consumers are looking for clean, sustainable, smart beauty solutions—a segment where brands with innovation and transparency can thrive.

Leading Players

Key players shaping the lip balm landscape include:

Established brands: NIVEA (including Labello), Burt’s Bees, EOS, Carmex, ChapStick, Vaseline.

Premium/beauty-centric: Fresh, Glossier, Dior, Prada.

Regional/ emerging players: Laneige, Himalaya Wellness, Mamaearth.

Notably, NIVEA achieved a 9% organic sales growth in 2024, with revenue rising to €5,601 million—thanks to expanded product ranges and strong performance across key markets.

Recent Launch Highlights (Mid-2025)

July 2025:

Hailey Bieber’s Rhode launched a new shade, Lemontini, for her Peptide Lip Tint line following e.l.f. Beauty’s acquisition of Rhode.

Ayesha Curry’s Sweet July introduced a trio of tropical-flavored lip treatments, combining seasonal appeal with wellness-focused formulas.

May 2025:

Laneige rolled out limited-edition Matcha and Taro flavors for its Lip Sleeping Mask, featuring ingredients like murumuru seed, shea butter, and vitamin C. The product has celebrity fans including Kendall Jenner and Meghan Markle.

Conclusion

The global lip balm market is in a phase of robust, dynamic transformation—from simple moisturizers to smart, multifunctional, and sustainable beauty essentials. With growth powered by innovation, influencer-driven trends, and evolving consumer values, brands that prioritize transparency, efficacy, and purpose-driven design are well-positioned to lead in the 2025–2030 landscape.