IMARC Group, a leading market research company, has recently released a report titled "Generic Oncology Drugs Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033." The study provides a detailed analysis of the industry, including the global generic oncology drugs market Trends, share, size, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Generic Oncology Drugs Market Overview:

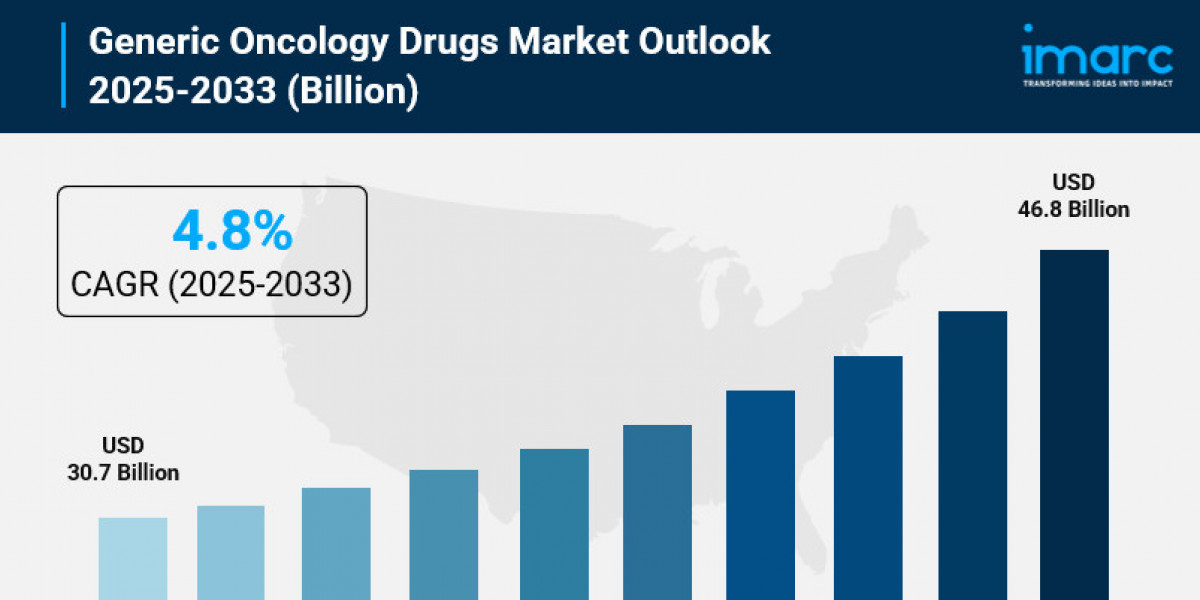

The global generic oncology drugs market reached a size of USD 30.7 Billion in 2024. It is projected to grow at a CAGR of 4.8% from 2025 to 2033, reaching USD 46.8 Billion by 2033. This growth is driven by the increasing prevalence of cancer, investments in novel drug research, and stringent regulatory measures enhancing drug production efficiency.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Generic Oncology Drugs Market Key Takeaways

- Current Market Size: USD 30.7 Billion (2024)

- CAGR: 4.8%

- Forecast Period: 2025-2033

- The rising global prevalence of cancer intensifies demand for affordable treatment options, making generics increasingly vital.

- Patent expirations for numerous blockbuster oncology drugs open markets for generic alternatives, fueling growth.

- North America holds the largest market share due to high cancer prevalence and supportive government policies.

- The growing focus on biosimilars and personalized medicine are notable trends in market evolution.

- Increasing government initiatives encourage the adoption of generics to reduce healthcare costs globally.

Request Your Free “Generic Oncology Drugs Market” Insights Sample PDF: https://www.imarcgroup.com/generic-oncology-drug-manufacturing-plant/requestsample

Market Growth Factors

The increased global occurrence of cancer is a main element causing the generic oncology drugs market's growth. The American Cancer Society stated projections of over 2 million new cancer cases in the US for 2024. The need for cost-effective drugs increases as cancer becomes more common. Generic oncology drugs became available and increased access for cancer treatment, especially in LMIC (low-income and middle-income countries), where high cost limits access for cancer care.

Government initiatives and tight regulations provide opportunities for generics. Gland Pharma received USFDA approval in April 2024 for launching its generic breast cancer drug 'Eribulin Mesylate Injection' in the United States with projected sales of USD 92 million in the country. Such policies encourage implementing generic substitution policies, fast-tracking approvals of generic drugs, and incentivizing cancer drug manufacturers to make them accessible and affordable.

Patent expiration for heavily prescribed cancer drugs has also driven this trend. According to the Government of India, well-known drugs such as Humira and Keytruda are set to go off patent, along with 23 other major drugs, by 2030. Being off-patent opens opportunities for worldwide generic manufacturers; the number of competitors in the market increases and patient costs decrease. Therefore, the outlook for the generic oncology drugs market is positive.

Market Segmentation

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America is the dominant region in the generic oncology drugs market, holding the largest market share. Growth is driven by high cancer prevalence, increased patent expirations of branded drugs, and supportive government policies promoting generics to reduce healthcare costs. In June 2024, Teva Pharmaceuticals launched the first generic GLP-1 drug Victoza in the U.S., exemplifying innovation in generic drug offerings that meet rising market demand.

Recent Developments & News

In June 2023, Aurobindo Pharma's subsidiary Eugia Pharma Specialities signed a sub-licensing agreement with Medicines Patent Pool to develop and market Nilotinib capsules for chronic myeloid leukemia treatment. In May 2024, BeiGene and Glenmark Pharmaceuticals’ subsidiary Glenmark Specialty S.A. entered an exclusive marketing and distribution agreement for tislelizumab, an FDA-, EMA-, and NMPA-approved anti-PD-1 monoclonal antibody used for treating advanced esophageal squamous cell carcinoma.

Key Players

- Teva Pharmaceuticals

- Mylan N.V.

- Sandoz (a Novartis division)

- Pfizer

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=545&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302